Question: Can i have some help please Suppose that EBV makes a $6M Series A investment in Newco for 1M shares at $6 per share. One

Can i have some help please

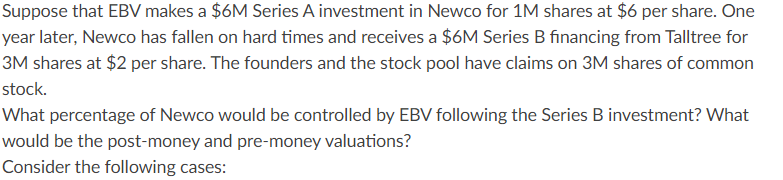

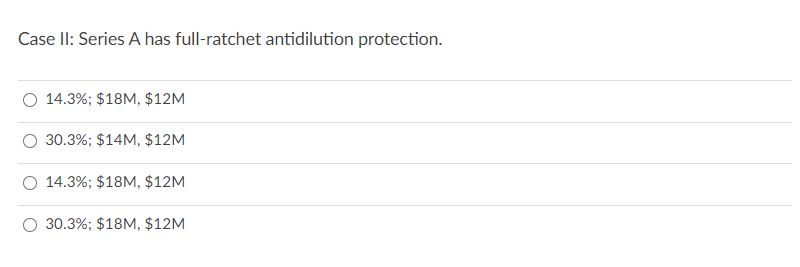

Suppose that EBV makes a $6M Series A investment in Newco for 1M shares at $6 per share. One year later, Newco has fallen on hard times and receives a $6M Series B financing from Talltree for 3M shares at $2 per share. The founders and the stock pool have claims on 3M shares of common stock. What percentage of Newco would be controlled by EBV following the Series B investment? What would be the post-money and pre-money valuations? Consider the following cases: Case II: Series A has full-ratchet antidilution protection. 14.3%; $18M, $12M 30.3%; $14M, $12M 14.3%; $18M, $12M 30.3%; $18M, $12M Suppose that EBV makes a $6M Series A investment in Newco for 1M shares at $6 per share. One year later, Newco has fallen on hard times and receives a $6M Series B financing from Talltree for 3M shares at $2 per share. The founders and the stock pool have claims on 3M shares of common stock. What percentage of Newco would be controlled by EBV following the Series B investment? What would be the post-money and pre-money valuations? Consider the following cases: Case II: Series A has full-ratchet antidilution protection. 14.3%; $18M, $12M 30.3%; $14M, $12M 14.3%; $18M, $12M 30.3%; $18M, $12M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts