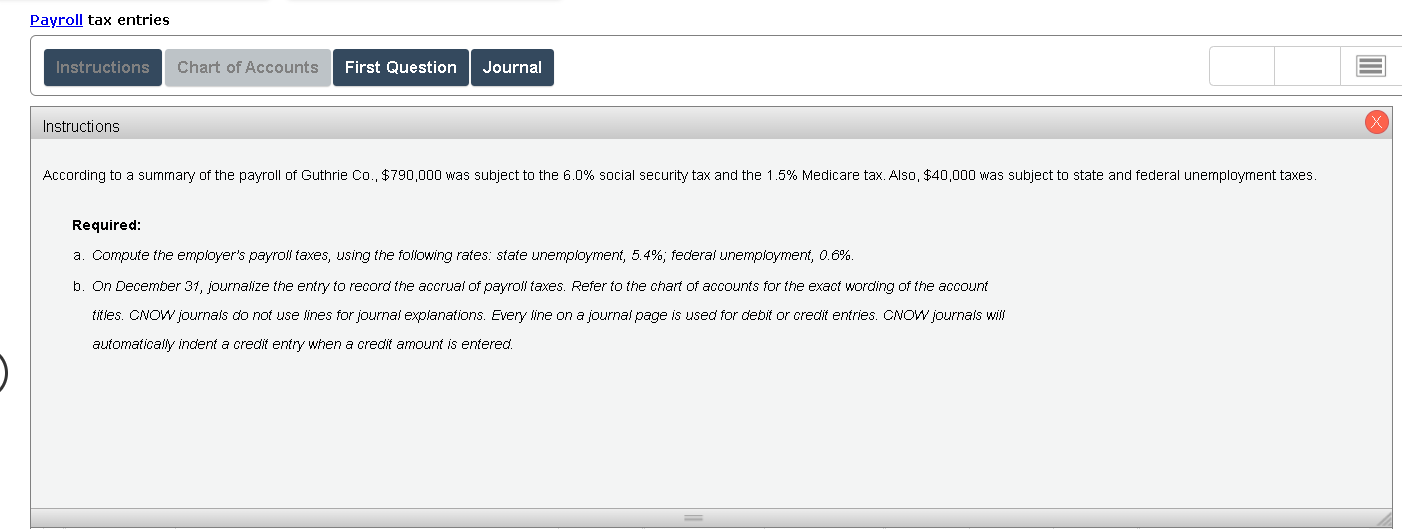

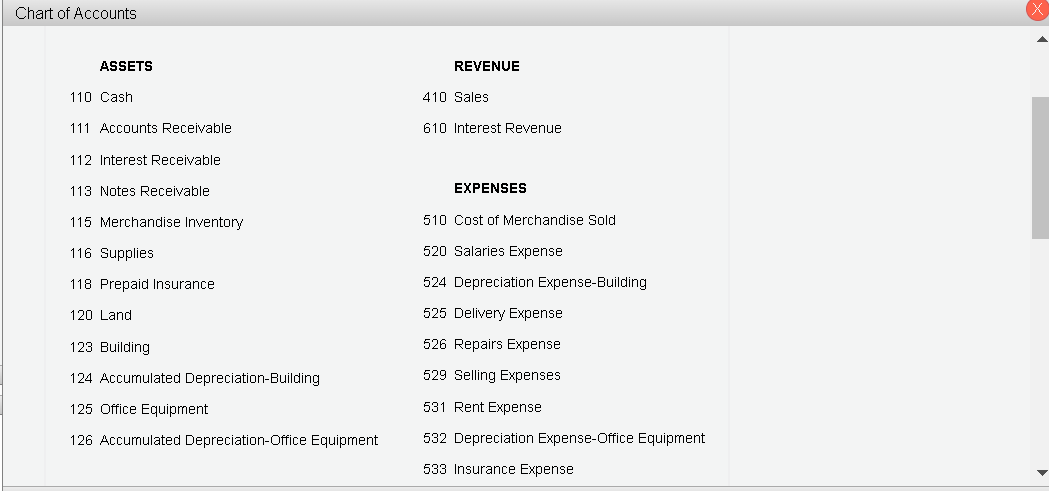

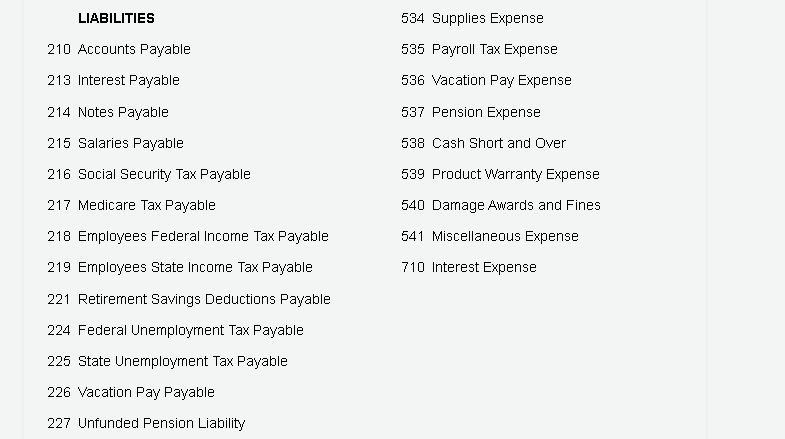

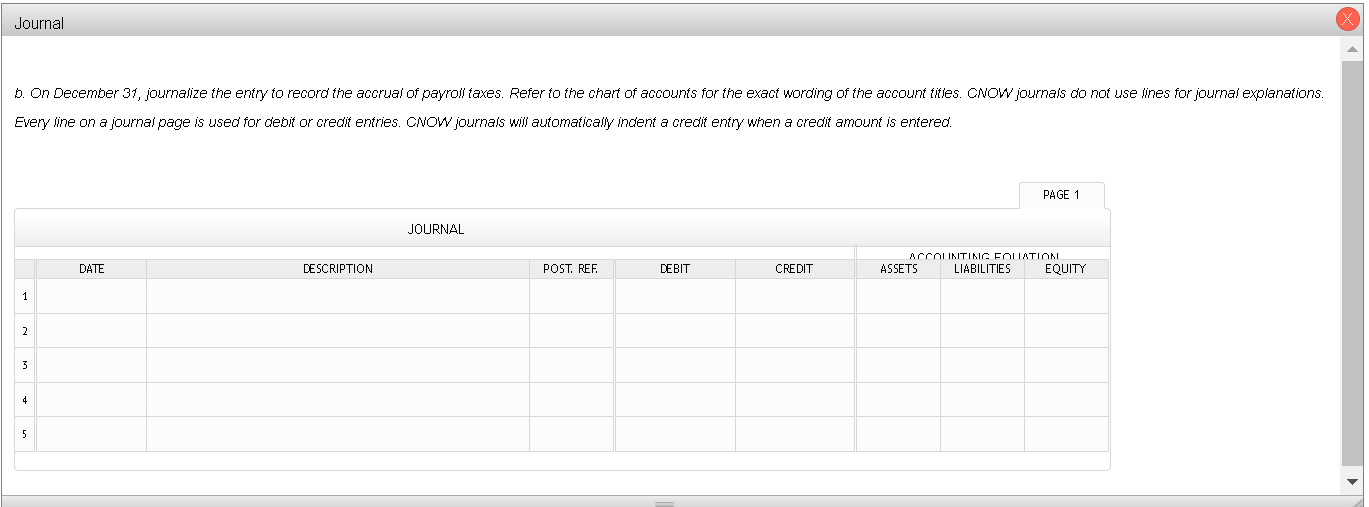

Question: Can I have some help with this question. I cannot get the math to equal out. Payroll tax entries Instructions Chart of Accounts First Question

Can I have some help with this question. I cannot get the math to equal out.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts