Question: Can I please get help for the answer to this question please thank u! Multiple Choice You require a rate of return of 15.2% Your

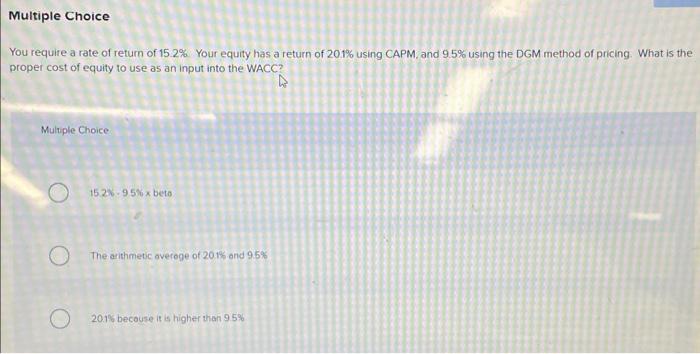

Multiple Choice You require a rate of return of 15.2% Your equity has a return of 20.1% using CAPM, and 95% using the DGM method of pricing. What is the proper cost of equity to use as an input into the WACC? Multiple Choice 15.2% -9.5% 5x beto The arithmetic average of 2016 and 95% 20.1% because it is higher than 95%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts