Question: can i please get help with a, b and d as they are related Fasteners Company has several divisions, and just built a new plant

can i please get help with a, b and d as they are related

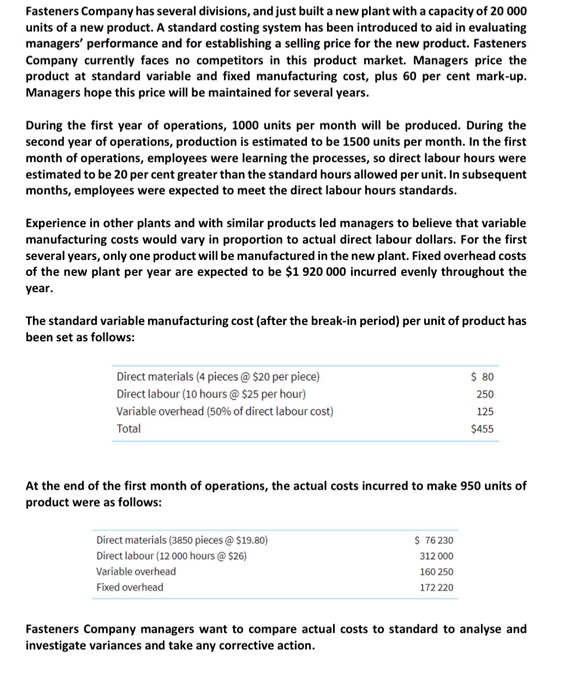

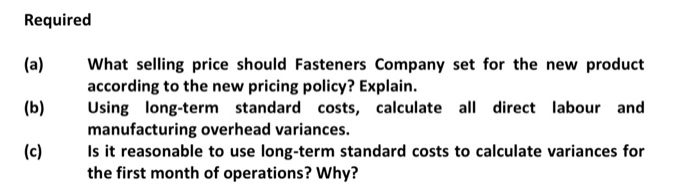

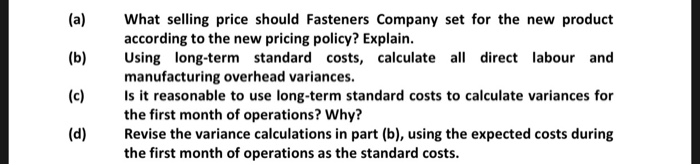

can i please get help with a, b and d as they are related Fasteners Company has several divisions, and just built a new plant with a capacity of 20 000 units of a new product. A standard costing system has been introduced to aid in evaluating managers' performance and for establishing a selling price for the new product. Fasteners Company currently faces no competitors in this product market. Managers price the product at standard variable and fixed manufacturing cost, plus 60 per cent mark-up. Managers hope this price will be maintained for several years. During the first year of operations, 1000 units per month will be produced. During the second year of operations, production is estimated to be 1500 units per month. In the first month of operations, employees were learning the processes, so direct labour hours were estimated to be 20 per cent greater than the standard hours allowed per unit. In subsequent months, employees were expected to meet the direct labour hours standards. Experience in other plants and with similar products led managers to believe that variable manufacturing costs would vary in proportion to actual direct labour dollars. For the first several years, only one product will be manufactured in the new plant. Fixed overhead costs of the new plant per year are expected to be $1 920 000 incurred evenly throughout the year. The standard variable manufacturing cost (after the break-in period) per unit of product has been set as follows: Direct materials (4 pieces @ $20 per piece) Direct labour (10 hours @ $25 per hour) Variable overhead (50% of direct labour cost) Total $ 80 250 125 $455 At the end of the first month of operations, the actual costs incurred to make 950 units of product were as follows: Direct materials (3850 pieces @ $19.80) Direct labour (12 000 hours @ $26) Variable overhead Fixed overhead $ 76230 312 000 160 250 172 220 Fasteners Company managers want to compare actual costs to standard to analyse and investigate variances and take any corrective action. Required (a) (b) What selling price should Fasteners Company set for the new product according to the new pricing policy? Explain. Using long-term standard costs, calculate all direct labour and manufacturing overhead variances. Is it reasonable to use long-term standard costs to calculate variances for the first month of operations? Why? (c) (a) (b) What selling price should Fasteners Company set for the new product according to the new pricing policy? Explain. Using long-term standard costs, calculate all direct labour and manufacturing overhead variances. Is it reasonable to use long-term standard costs to calculate variances for the first month of operations? Why? Revise the variance calculations in part (b), using the expected costs during the first month of operations as the standard costs. (c) (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts