Question: can i please get help with this question step by step 5. (10+10+05=25 marks ) You are given the following information: (i) S(t) is the

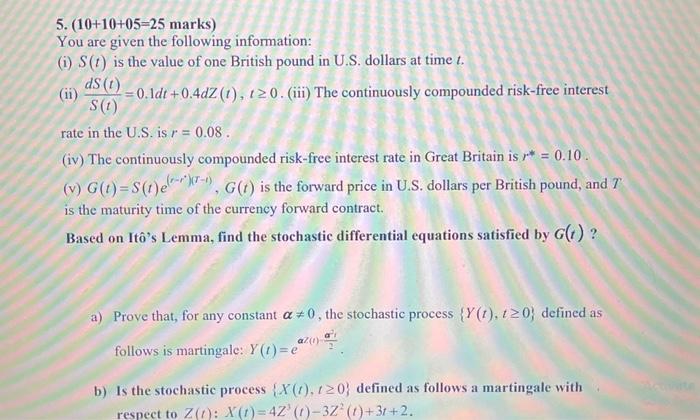

5. (10+10+05=25 marks ) You are given the following information: (i) S(t) is the value of one British pound in U.S. dollars at time t. (ii) S(t)dS(t)=0.1dt+0.4dZ(t),t0. (iii) The continuously compounded risk-free interest rate in the U.S. is r=0.08. (iv) The continuously compounded risk-free interest rate in Great Britain is r=0.10. (v) G(t)=S(t)e(rr)(Tt),G(t) is the forward price in U.S. dollars per British pound, and T is the maturity time of the currency forward contract. Based on It's Lemma, find the stochastic differential equations satisfied by G(t) ? a) Prove that, for any constant =0, the stochastic process {Y(t),t0} defined as follows is martingale: Y(t)=ez(t)22. b) Is the stochastic process {X(t),t0} defined as follows a martingale with respect to Z(t):X(t)=4Z3(t)3Z2(t)+3t+2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts