Question: Can I please get some help answering? I'm stuck! Question based on case informaiton Case information: Cyber Systems Pty Ltd is a provider of web

Can I please get some help answering? I'm stuck!

Question based on case informaiton

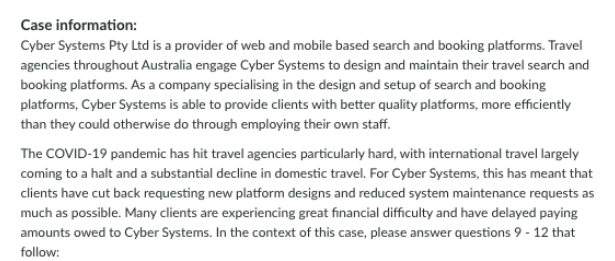

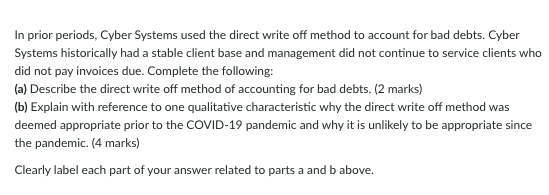

Case information: Cyber Systems Pty Ltd is a provider of web and mobile based search and booking platforms. Travel agencies throughout Australia engage Cyber Systems to design and maintain their travel search and booking platforms. As a company specialising in the design and setup of search and booking platforms, Cyber Systems is able to provide clients with better quality platforms, more efficiently than they could otherwise do through employing their own staff. The COVID-19 pandemic has hit travel agencies particularly hard, with international travel largely coming to a halt and a substantial decline in domestic travel. For Cyber Systems, this has meant that clients have cut back requesting new platform designs and reduced system maintenance requests as much as possible. Many clients are experiencing great financial difficulty and have delayed paying amounts owed to Cyber Systems. In the context of this case, please answer questions 9 - 12 that follow:In prior periods, Cyber Systems used the direct write off method to account for bad debts. Cyber Systems historically had a stable client base and management did not continue to service clients who did not pay invoices due. Complete the following: (a) Describe the direct write off method of accounting for bad debts. (2 marks) (b) Explain with reference to one qualitative characteristic why the direct write off method was deemed appropriate prior to the COVID-19 pandemic and why it is unlikely to be appropriate since the pandemic. (4 marks) Clearly label each part of your answer related to parts a and b above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts