Question: Can I please get some help getting the IRR or NPV for this problem? I understand how to get the OCF for the problem necessary

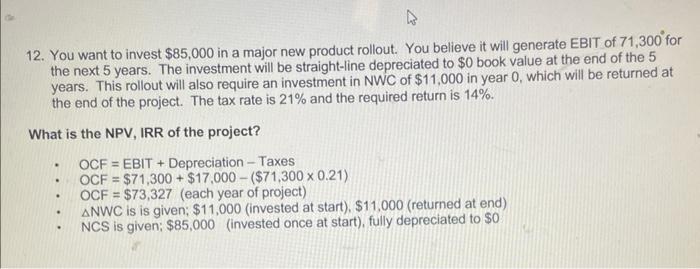

12. You want to invest $85,000 in a major new product rollout. You believe it will generate EBIT of 71,300 for the next 5 years. The investment will be straight-line depreciated to $0 book value at the end of the 5 years. This rollout will also require an investment in NWC of $11,000 in year 0, which will be returned at the end of the project. The tax rate is 21% and the required return is 14%. What is the NPV, IRR of the project? OCF = EBIT + Depreciation - Taxes OCF = $71,300 + $17,000 -($71,300 x 0.21) OCF = $73,327 (each year of project) ANWC is is given: $11,000 (invested at start) $11,000 (returned at end) NCS is given; $85,000 (invested once at start), fully depreciated to $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts