Question: Can I please get some help on this question? Recording Entries for Equity Investment: Equity Method, Partial Year On July 1, 2020, Allen Corporation purchased

Can I please get some help on this question?

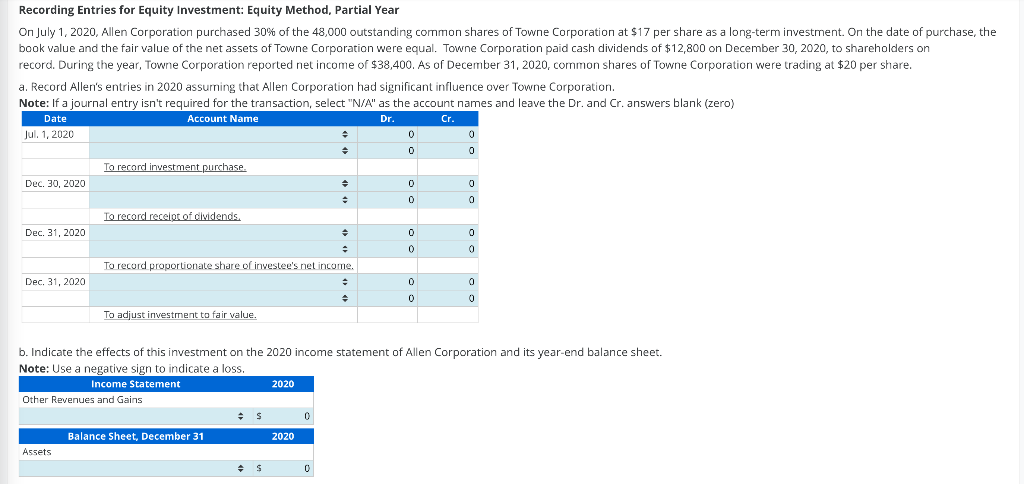

Recording Entries for Equity Investment: Equity Method, Partial Year On July 1, 2020, Allen Corporation purchased 30% of the 48,000 outstanding common shares of Towne Corporation at $17 per share as a long-term investment. On the date of purchase, the book value and the fair value of the net assets of Towne Corporation were equal. Towne Corporation paid cash dividends of $12,800 on December 30, 2020, to shareholders on record. During the year, Towne Corporation reported net income of $38,400. As of December 31, 2020, common shares of Towne Corporation were trading at $20 per share. a. Record Allen's entries in 2020 assuming that Allen Corporation had significant influence over Towne Corporation. Note: If a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero) Date Account Name Dr. Cr. Jul. 1, 2020 0 0 0 0 To record investment purchase. Dec. 30, 2020 0 0 + 0 0 To record receipt of dividends. Dec. 31, 2020 0 0 0 0 To record proportionate share of investee's net income. Dec. 31, 2020 0 0 0 0 To adjust investment to fair value. b. Indicate the effects of this investment on the 2020 income statement of Allen Corporation and its year-end balance sheet. Note: Use a negative sign to indicate a loss. Income Statement 2020 Other Revenues and Gains Balance Sheet, December 31 2020 Assets. S 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts