Question: Can I please have help with these case study problems? Details and explanations would be much appreciated. Thank you! Case 1: Cash Flow Below are

Can I please have help with these case study problems? Details and explanations would be much appreciated. Thank you!

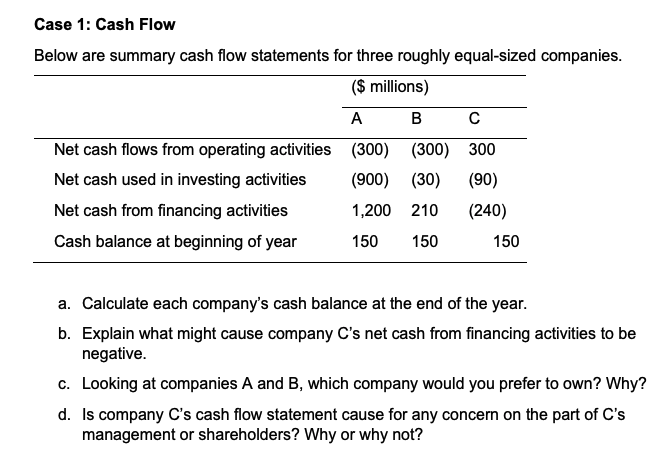

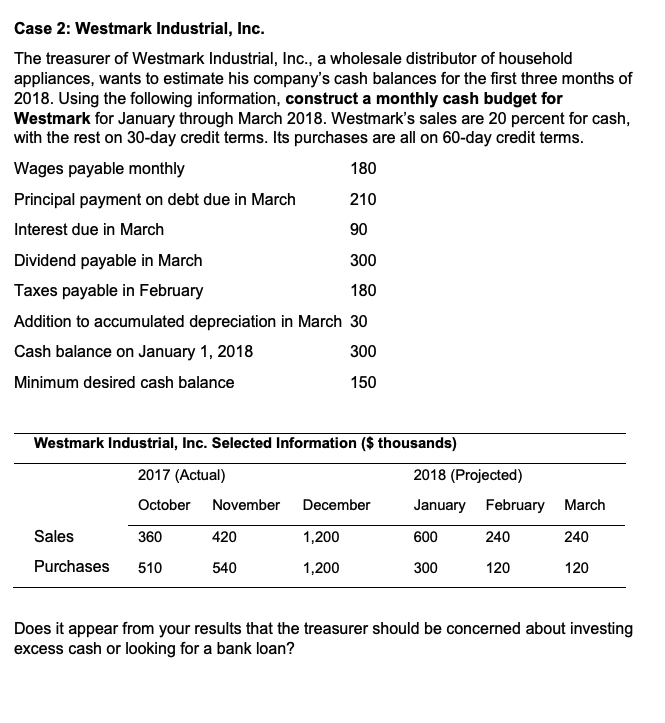

Case 1: Cash Flow Below are summary cash flow statements for three roughly equal-sized companies. a. Calculate each company's cash balance at the end of the year. b. Explain what might cause company C's net cash from financing activities to be negative. c. Looking at companies A and B, which company would you prefer to own? Why? d. Is company C's cash flow statement cause for any concern on the part of C's management or shareholders? Why or why not? Case 2: Westmark Industrial, Inc. The treasurer of Westmark Industrial, Inc., a wholesale distributor of household appliances, wants to estimate his company's cash balances for the first three months of 2018. Using the following information, construct a monthly cash budget for Westmark for January through March 2018. Westmark's sales are 20 percent for cash, with the rest on 30 -day credit terms. Its purchases are all on 60 -day credit terms. Does it appear from your results that the treasurer should be concerned about investing excess cash or looking for a bank loan? Case 1: Cash Flow Below are summary cash flow statements for three roughly equal-sized companies. a. Calculate each company's cash balance at the end of the year. b. Explain what might cause company C's net cash from financing activities to be negative. c. Looking at companies A and B, which company would you prefer to own? Why? d. Is company C's cash flow statement cause for any concern on the part of C's management or shareholders? Why or why not? Case 2: Westmark Industrial, Inc. The treasurer of Westmark Industrial, Inc., a wholesale distributor of household appliances, wants to estimate his company's cash balances for the first three months of 2018. Using the following information, construct a monthly cash budget for Westmark for January through March 2018. Westmark's sales are 20 percent for cash, with the rest on 30 -day credit terms. Its purchases are all on 60 -day credit terms. Does it appear from your results that the treasurer should be concerned about investing excess cash or looking for a bank loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts