Question: can I please know how these are solved ? Alex Stock Exchange (ASE) has the following outstanding bids: {60, 100, 90, 80, 80, 70} for

can I please know how these are solved ?

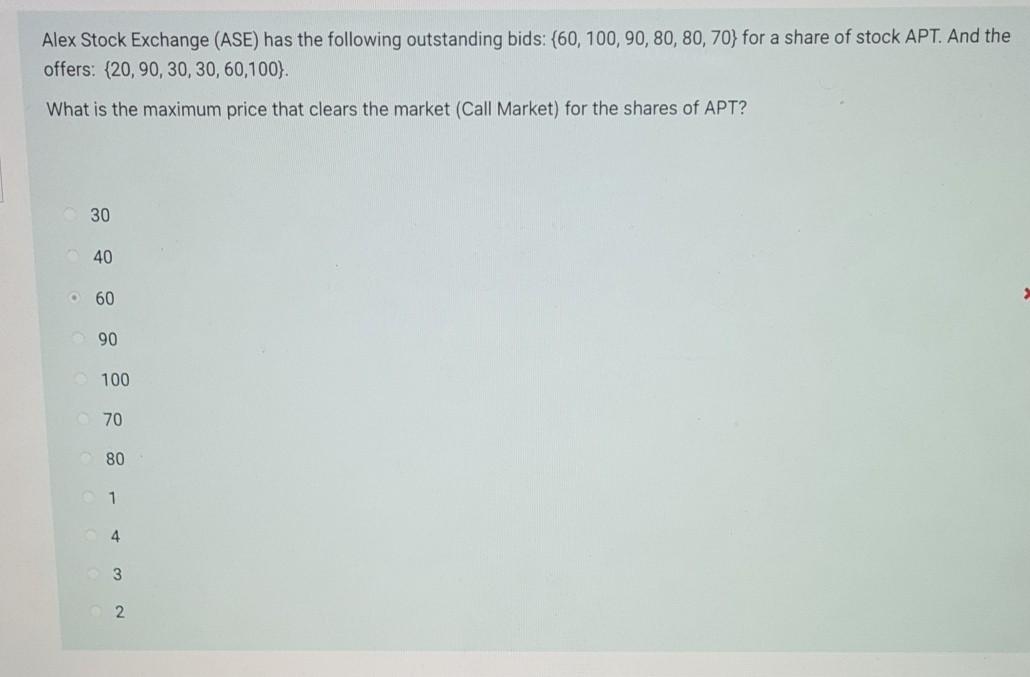

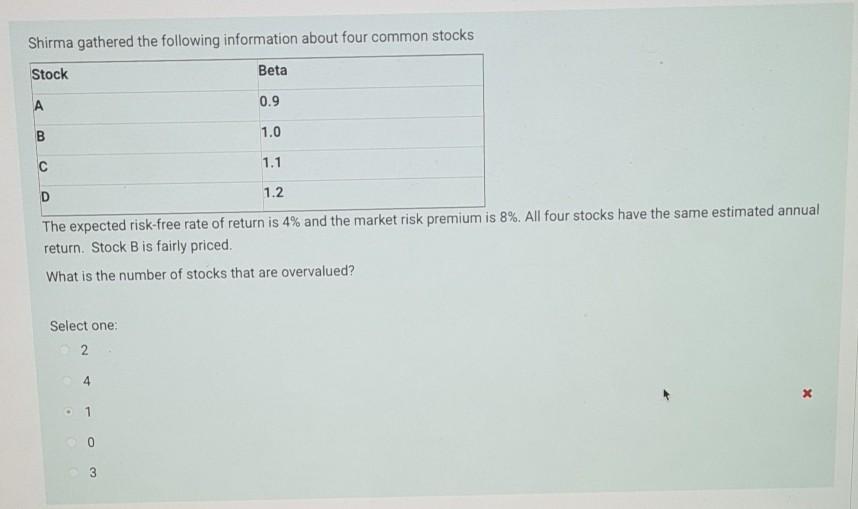

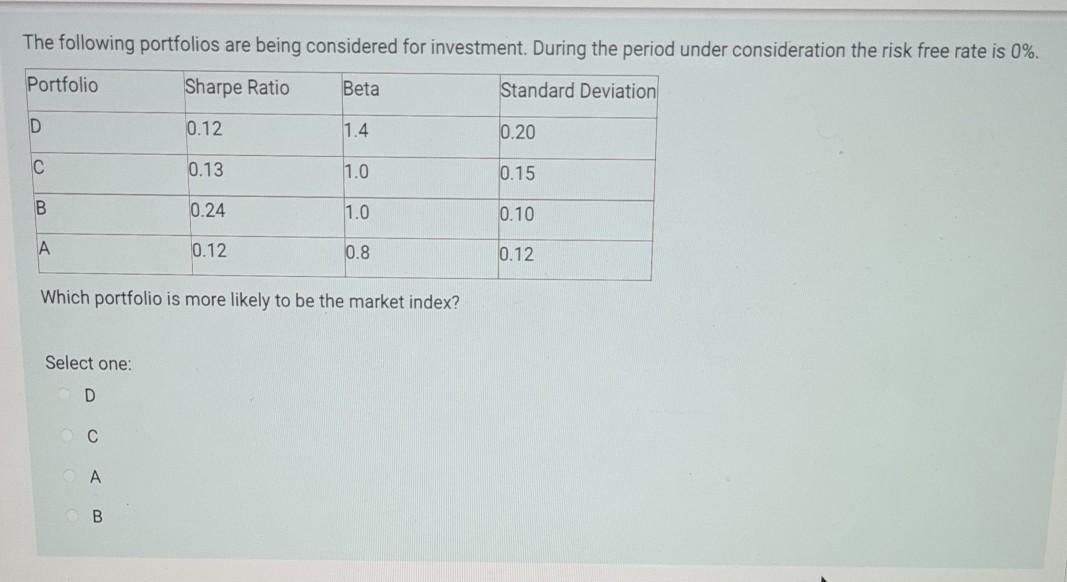

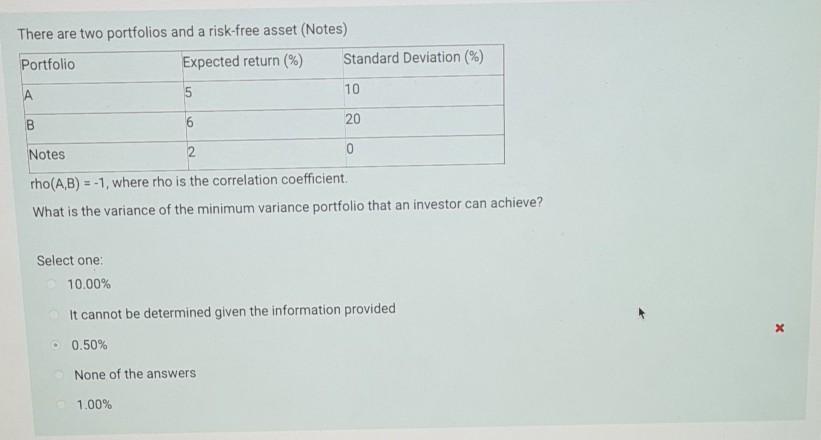

Alex Stock Exchange (ASE) has the following outstanding bids: {60, 100, 90, 80, 80, 70} for a share of stock APT. And the offers: (20,90, 30, 30, 60,100). What is the maximum price that clears the market (Call Market) for the shares of APT? 30 40 . 60 90 100 70 80 4 3 2 Shirma gathered the following information about four common stocks Stock Beta 0.9 1.0 1.1 D 1.2 The expected risk-free rate of return is 4% and the market risk premium is 8%. All four stocks have the same estimated annual return. Stock B is fairly priced. What is the number of stocks that are overvalued? Select one: 2 4 X . 1 0 3 The following portfolios are being considered for investment. During the period under consideration the risk free rate is 0%. Portfolio Sharpe Ratio Beta Standard Deviation 0.12 1.4 0.20 C 0.13 1.0 0.15 B 10.24 1.0 0.10 A 0.12 0.8 0.12 Which portfolio is more likely to be the market index? Select one: D A B There are two portfolios and a risk-free asset (Notes) Portfolio Expected return (%) Standard Deviation (%) 5 10 B 6 20 Notes 0 rho(A,B) = -1, where tho is the correlation coefficient. What is the variance of the minimum variance portfolio that an investor can achieve? Select one: 10.00% It cannot be determined given the information provided 0.50% None of the answers 1.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts