Question: Can please someone help me solve this problem. Thank you 4. 122 points) Brenda works at the currency trading unit of Bank of the West

Can please someone help me solve this problem. Thank you

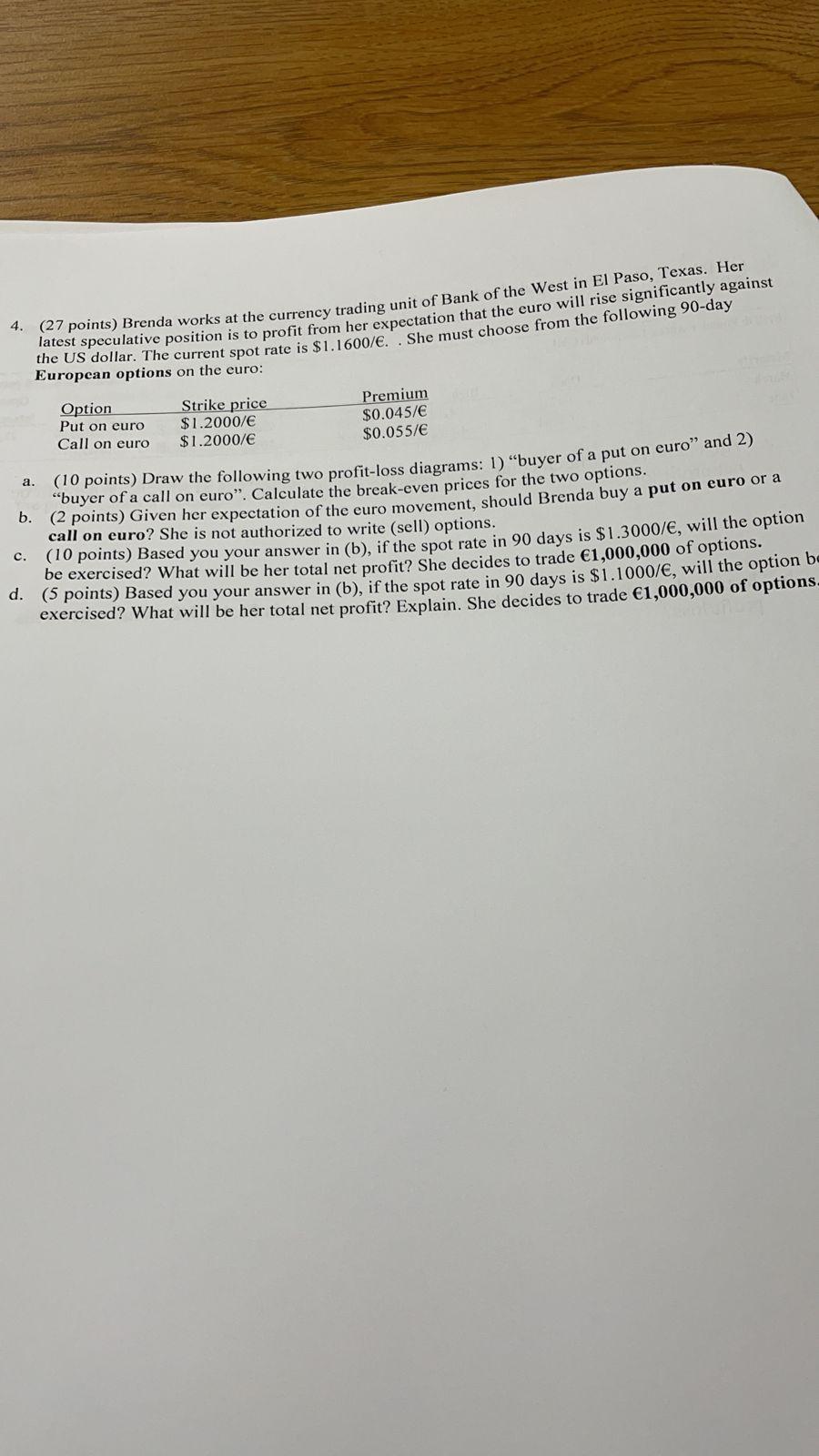

4. 122 points) Brenda works at the currency trading unit of Bank of the West in El Paso, Texas. Her theest speculative position is to profit from her expectation that the euro will rise significantly against the US dollar. The current spot rate is $1.1600/.". She must choose from the following 90-day European options on the euro: Option Put on euro Call on euro Strike price $1.2000/ $1.2000/ a. b. Premium $0.045/6 $0.055/6 "buyer of a call on euro. Calculate the break-even prices for the two options. 10 points) Draw the following two profit-loss diagrams: 1) "buyer of a put on euro and 2) (2 points) Given her expectation of the euro movement, should Brenda buy a put on euro or a call on euro? She is not authorized to write (sell) options. (10 points) Based you your answer in (b), if the spot rate in 90 days is $ 1.3000/, will the option be exercised? What will be her total net profit? She decides to trade 1,000,000 of options. d. (s points) Based you your answer in (b), if the spot rate in 90 days is $1.1000/, will the option be exercised? What will be her total net profit? Explain. She decides to trade 1,000,000 of options- c. 4. 122 points) Brenda works at the currency trading unit of Bank of the West in El Paso, Texas. Her theest speculative position is to profit from her expectation that the euro will rise significantly against the US dollar. The current spot rate is $1.1600/.". She must choose from the following 90-day European options on the euro: Option Put on euro Call on euro Strike price $1.2000/ $1.2000/ a. b. Premium $0.045/6 $0.055/6 "buyer of a call on euro. Calculate the break-even prices for the two options. 10 points) Draw the following two profit-loss diagrams: 1) "buyer of a put on euro and 2) (2 points) Given her expectation of the euro movement, should Brenda buy a put on euro or a call on euro? She is not authorized to write (sell) options. (10 points) Based you your answer in (b), if the spot rate in 90 days is $ 1.3000/, will the option be exercised? What will be her total net profit? She decides to trade 1,000,000 of options. d. (s points) Based you your answer in (b), if the spot rate in 90 days is $1.1000/, will the option be exercised? What will be her total net profit? Explain. She decides to trade 1,000,000 of options- c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts