Question: Can some explain to me how I got this answer wrong? my math seems to be correct, any feedback will help! Percent of Sales Method

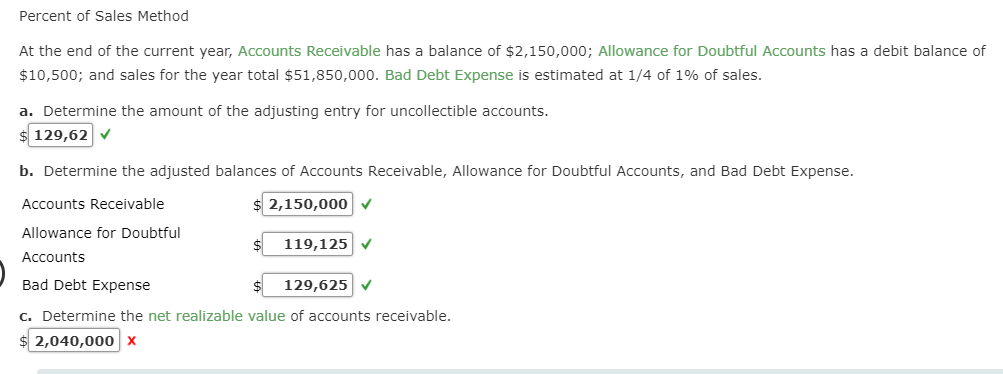

Can some explain to me how I got this answer wrong? my math seems to be correct, any feedback will help!

Percent of Sales Method At the end of the current year, Accounts Receivable has a balance of $2,150,000; Allowance for Doubtful Accounts has a debit balance of $10,500; and sales for the year total $51,850,000. Bad Debt Expense is estimated at 1/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. $ 129,62 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $ 2,150,000 Allowance for Doubtful $ 119,125 Accounts Bad Debt Expense $ 129,625 c. Determine the net realizable value of accounts receivable. $ 2,040,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts