Question: Can some one explain the number 2 part LIF0 I dont know were 800*18.25 comes from. 1)Using FIFO: first purchased will be first sold COGS=(1000*18)+(1800*18.25)=50850

Can some one explain the number 2 part LIF0

I dont know were 800*18.25 comes from.

1)Using FIFO: first purchased will be first sold COGS=(1000*18)+(1800*18.25)=50850 Ending inventory=(14800+22800)=37600

2)LIFO:last in first out COGS=(1200*19)+(800*18.5)+(800*18.25)=52200 Ending inventory=(1000*18)+(1000*18.25)=36250

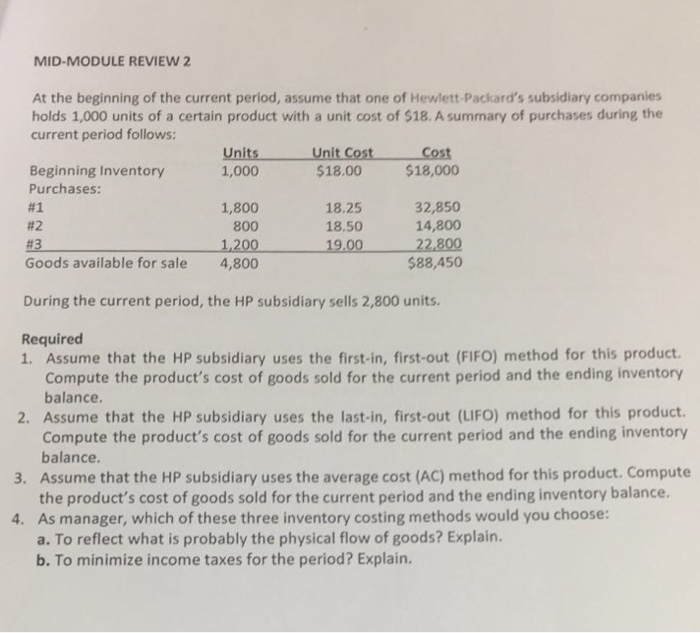

At the beginning of the current period, assume that one of Hewlett-Packard's subsidiary companies holds 1,000 units of a certain product with a unit cost of $18. A summary of purchases during the current period follows: During the current period, the HP subsidiary sells 2,800 units. Required 1. Assume that the HP subsidiary uses the first-in, first-out (FIFO) method for this product. Compute the product's cost of goods sold for the current period and the ending inventory balance. 2. Assume that the HP subsidiary uses the last-in, first-out (LIFO) method for this product. Compute the product's cost of goods sold for the current period and the ending inventory balance. 3. Assume that the HP subsidiary uses the average cost (AC) method for this product. Compute the product's cost of goods sold for the current period and the ending inventory balance. 4. As manager, which of these three inventory costing methods would you choose: a. To reflect what is probably the physical flow of goods? Explain. b. To minimize income taxes for the period? Explain. At the beginning of the current period, assume that one of Hewlett-Packard's subsidiary companies holds 1,000 units of a certain product with a unit cost of $18. A summary of purchases during the current period follows: During the current period, the HP subsidiary sells 2,800 units. Required 1. Assume that the HP subsidiary uses the first-in, first-out (FIFO) method for this product. Compute the product's cost of goods sold for the current period and the ending inventory balance. 2. Assume that the HP subsidiary uses the last-in, first-out (LIFO) method for this product. Compute the product's cost of goods sold for the current period and the ending inventory balance. 3. Assume that the HP subsidiary uses the average cost (AC) method for this product. Compute the product's cost of goods sold for the current period and the ending inventory balance. 4. As manager, which of these three inventory costing methods would you choose: a. To reflect what is probably the physical flow of goods? Explain. b. To minimize income taxes for the period? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts