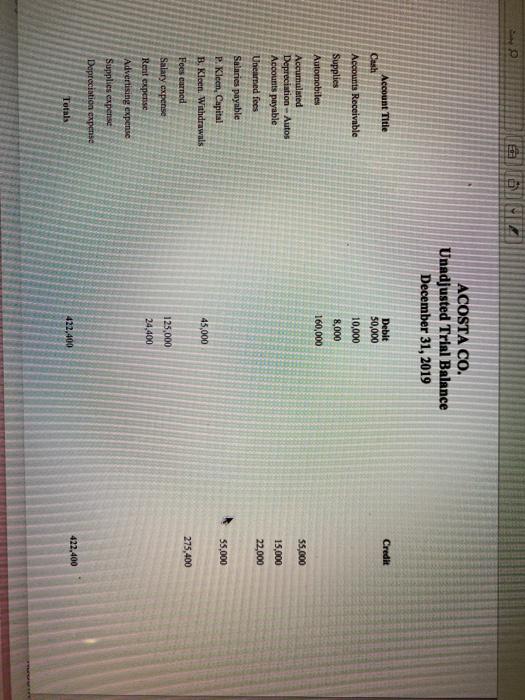

Question: can some one help me .. is my answer True? ACOSTA CO. Unadjusted Trial Balance December 31, 2019 Credit Account Title Cash Debit 50,000 Accounts

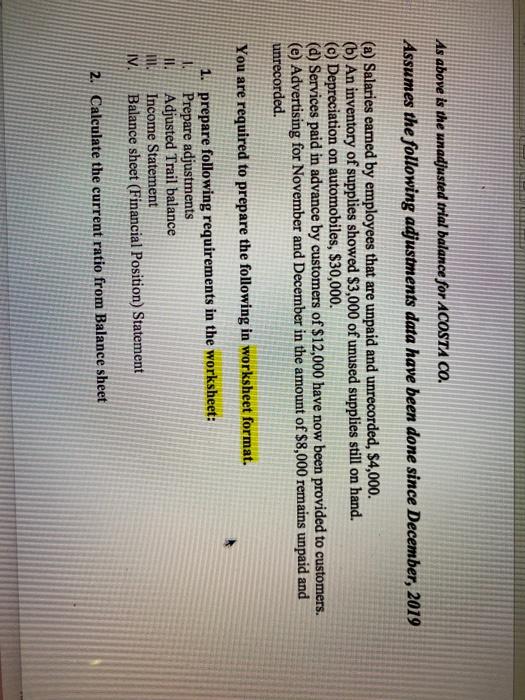

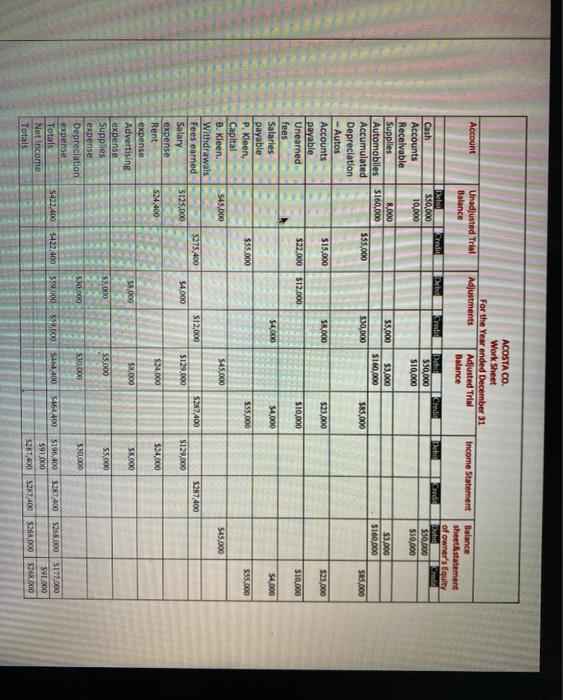

ACOSTA CO. Unadjusted Trial Balance December 31, 2019 Credit Account Title Cash Debit 50,000 Accounts Receivable 10,000 8,000 Supplies Automobiles 160,000 55,000 Accumulated Depreciation - Autos Accounts payable Unearned fees 15,000 22,000 Salaries payable P.Kleen, Capital B. Kloen. Withdrawals 55,000 45,000 Fecs urned 275,400 Salary expense 125,000 24,400 Rent expense Advertising expense Supplies expense Depreciation expense 12.00 422,400 422,400 Totals As above is the unadjusted trial balance for ACOSTA CO. Assumes the following adjustments data have been done since December, 2019 (a) Salaries earned by employees that are unpaid and unrecorded, $4,000. (b) An inventory of supplies showed $3,000 of unused supplies still on hand. (c) Depreciation on automobiles, $30,000. (d) Services paid in advance by customers of $12,000 have now been provided to customers. (e) Advertising for November and December in the amount of $8,000 remains unpaid and unrecorded. You are required to prepare the following in worksheet format. 1. prepare following requirements in the worksheet: Prepare adjustments Adjusted Trail balance III. Income Statement IV Balance sheet (Financial Position) Statement 2. Calculate the current ratio from Balance sheet ACOSTA CO. Work Sheet For the Year ended December 31 Adjustments Adjusted Trial Balance Account Unadjusted Trial Balance Income Statement Cred Dubi Credit 550,000 $10.000 Balance sheetstatement of owner's Equity Debid Credi SSO DOO SI0.000 $3,000 S160.000 $3.000 $160.000 $85,000 $85.000 $23,000 $23,000 $10,000 $10.000 54.com $4,000 $4.000 $55.000 $55.000 Debi Credil Debid Crede Cash $50,000 Accounts 10,000 Receivable Supplies 8.000 $5,000 Automobilles 5160,000 Accumulated $55,000 $30,000 Depreciation - Autos Accounts 515,000 58,000 payable Unearned $22,000 $12.000 fees Salaries $4.000 payable P. Kleen, $55,000 Capital B. Kleen. S45,000 Withdrawals Fees earned $275,400 $12,000 Salary $125.000 $4,000 expense Rent $24,400 expense Advertising $8.000 expense Supplies 55.000 expense Depreciation $30,000 expense Totals $422.400 $422.400 $59,000 559.000 Net Income Totals $45.000 545,000 $287.400 5287,400 $129.000 $129.000 $24.000 $24,000 58.000 55.000 S5.000 S5.000 $30,000 530,000 $464.400 5464.400 5196,400 $287.400 $268.000 $177,000 591,000 $95.000 5257,400 $267.400 5268,000 $268.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts