Question: Can some one please answer the question 1SE from Chapter 8 in the text book solutions please!!!! Jane is considering investing in three different stocks

Can some one please answer the question 1SE from Chapter 8 in the text book solutions please!!!!

Can some one please answer the question 1SE from Chapter 8 in the text book solutions please!!!!

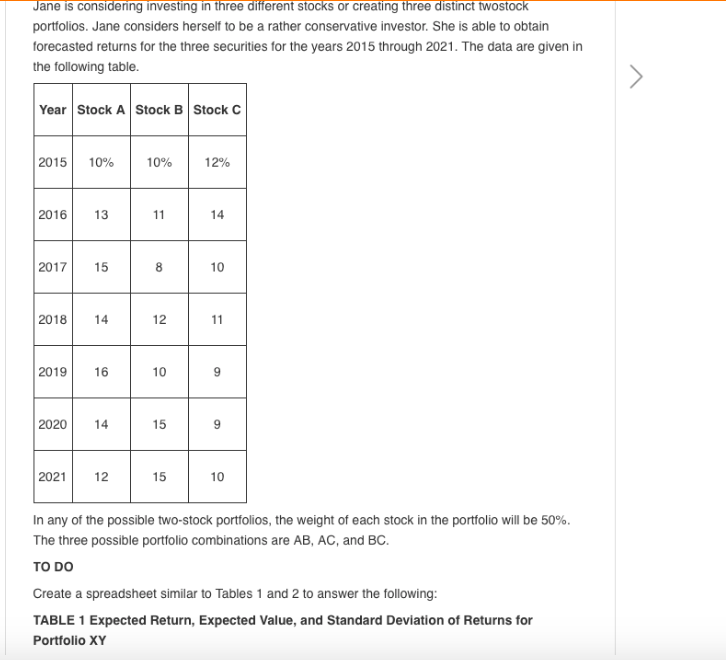

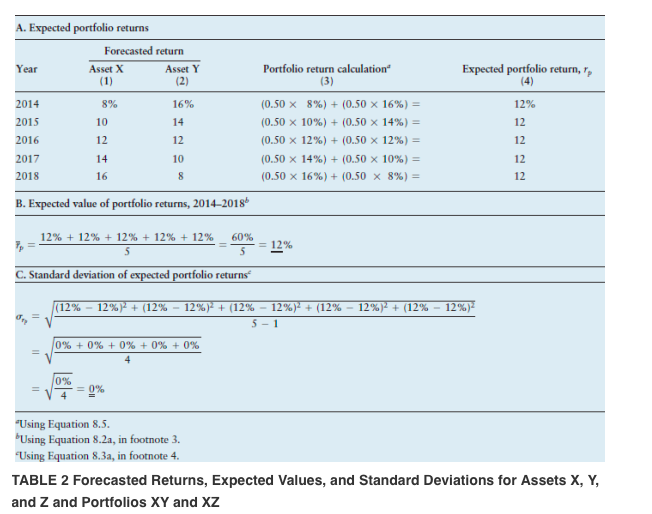

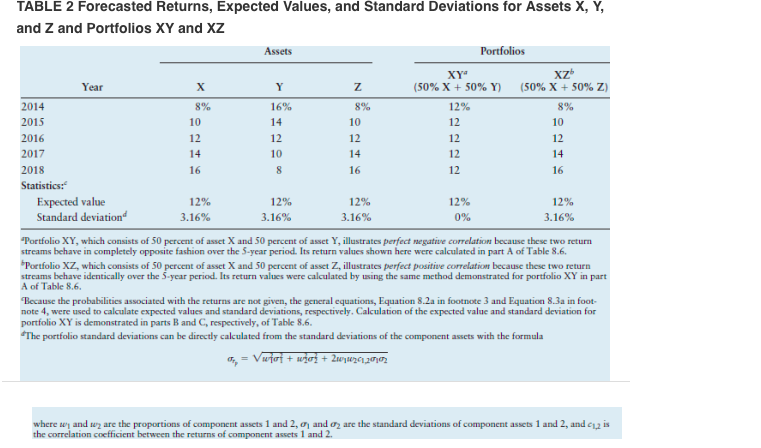

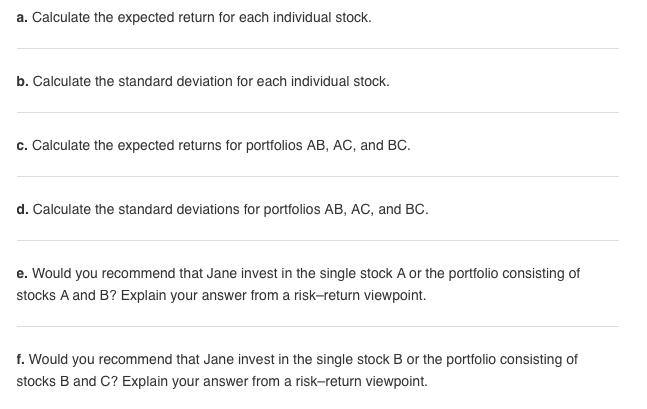

Jane is considering investing in three different stocks or creating three distinct two stock portfolios. Jane considers herself to be a rather conservative investor. She is able to obtain forecasted returns for the three securities for the years 2015 through 2021. The data are given in the following table. In any of the possible two-stock portfolios, the weight of each stock in the portfolio will be 50%. The three possible portfolio combinations are AB, AC, and BC. Create a spreadsheet similar to Tables 1 and 2 to answer the following: TABLE 1 Expected Return, Expected Value, and Standard Deviation of Returns for Portfolio XY TABLE 2 Forecasted Returns, Expected Values, and Standard Deviations for Assets X, Y, and Z and Portfolios XY and XZ a. Calculate the expected return for each individual stock. b. Calculate the standard deviation for each individual stock. c. Calculate the expected returns for portfolios AB, AC, and BC. d. Calculate the standard deviations for portfolios AB, AC, and BC. e. Would you recommend that Jane invest in the single stock A or the portfolio consisting of stocks A and B? Explain your answer from a risk-return viewpoint. f. Would you recommend that Jane invest in the single stock B or the portfolio consisting of stocks B and C? Explain your answer from a risk-return viewpoint. Principles of Managerial Finance, Brief Plus NEW MyFinanceLab with Pe... Author. Gitman, Lawrence J; Zutter, Chad J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts