Question: can some one please solve this problem (10 marks) As a President of AMC Inc., you are facing with a major decision. One of the

can some one please solve this problem

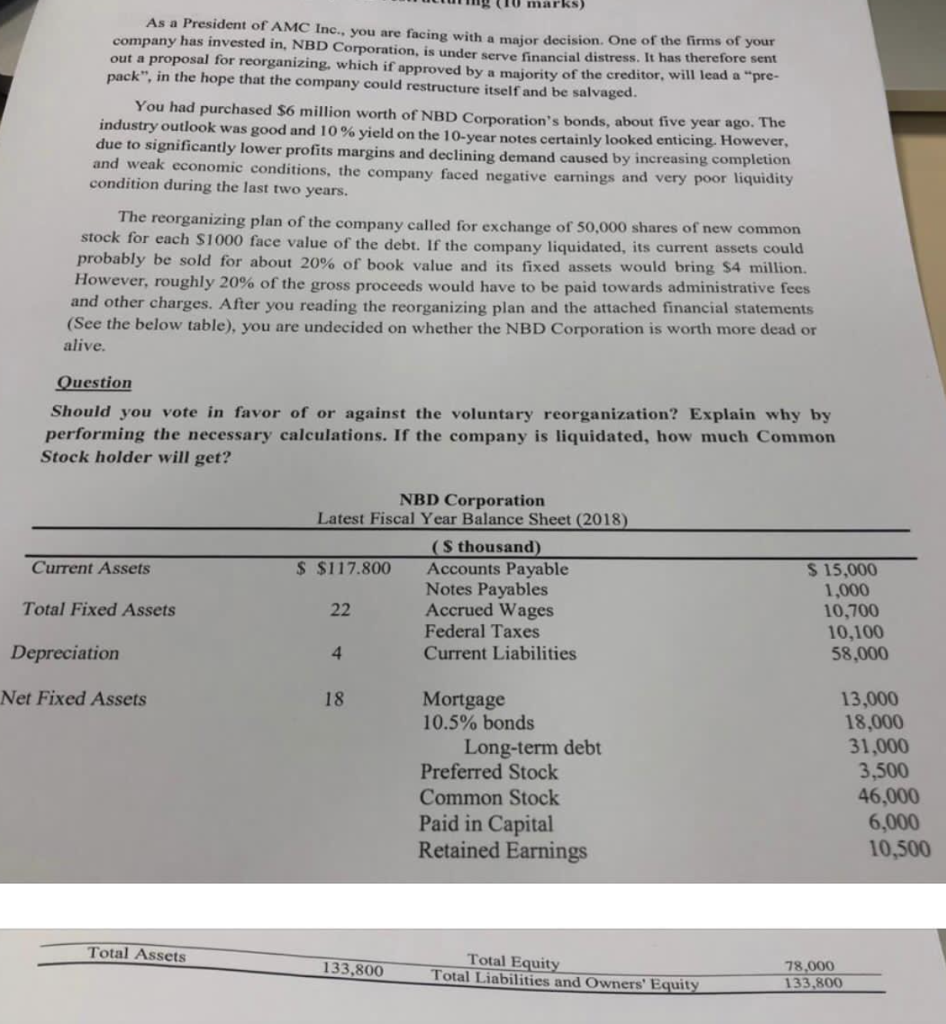

(10 marks) As a President of AMC Inc., you are facing with a major decision. One of the firms of your company has invested in, NBD Corporation, is under serve financial distress. It has therefore sent out a proposal for reorganizing, which if approved by a majority of the creditor, will lead a "pre- pack", in the hope that the company could restructure itself and be salvaged. You had purchased $6 million worth of NBD Corporation's bonds, about five year ago. The industry outlook was good and 10% yield on the 10-year notes certainly looked enticing. However, due to significantly lower profits margins and declining demand caused by increasing completion and weak economic conditions, the company faced negative earnings and very poor liquidity condition during the last two years. The reorganizing plan of the company called for exchange of 50,000 shares of new common stock for each $1000 face value of the debt. If the company liquidated, its current assets could probably be sold for about 20% of book value and its fixed assets would bring S4 million. However, roughly 20% of the gross proceeds would have to be paid towards administrative fees and other charges. After you reading the reorganizing plan and the attached financial statements (See the below table), you are undecided on whether the NBD Corporation is worth more dead or alive. Question Should you vote in favor of or against the voluntary reorganization? Explain why by performing the necessary calculations. If the company is liquidated, how much Common Stock holder will get? Current Assets NBD Corporation Latest Fiscal Year Balance Sheet (2018) (S thousand) $ $117.800 Accounts Payable Notes Payables 22 Accrued Wages Federal Taxes 4 Current Liabilities Total Fixed Assets $ 15,000 1,000 10,700 10,100 58,000 Depreciation Net Fixed Assets 18 Mortgage 10.5% bonds Long-term debt Preferred Stock Common Stock Paid in Capital Retained Earnings 13,000 18,000 31,000 3,500 46,000 6,000 10,500 Total Assets 133,800 Total Equity Total Liabilities and Owners' Equity 78,000 133,800 (10 marks) As a President of AMC Inc., you are facing with a major decision. One of the firms of your company has invested in, NBD Corporation, is under serve financial distress. It has therefore sent out a proposal for reorganizing, which if approved by a majority of the creditor, will lead a "pre- pack", in the hope that the company could restructure itself and be salvaged. You had purchased $6 million worth of NBD Corporation's bonds, about five year ago. The industry outlook was good and 10% yield on the 10-year notes certainly looked enticing. However, due to significantly lower profits margins and declining demand caused by increasing completion and weak economic conditions, the company faced negative earnings and very poor liquidity condition during the last two years. The reorganizing plan of the company called for exchange of 50,000 shares of new common stock for each $1000 face value of the debt. If the company liquidated, its current assets could probably be sold for about 20% of book value and its fixed assets would bring S4 million. However, roughly 20% of the gross proceeds would have to be paid towards administrative fees and other charges. After you reading the reorganizing plan and the attached financial statements (See the below table), you are undecided on whether the NBD Corporation is worth more dead or alive. Question Should you vote in favor of or against the voluntary reorganization? Explain why by performing the necessary calculations. If the company is liquidated, how much Common Stock holder will get? Current Assets NBD Corporation Latest Fiscal Year Balance Sheet (2018) (S thousand) $ $117.800 Accounts Payable Notes Payables 22 Accrued Wages Federal Taxes 4 Current Liabilities Total Fixed Assets $ 15,000 1,000 10,700 10,100 58,000 Depreciation Net Fixed Assets 18 Mortgage 10.5% bonds Long-term debt Preferred Stock Common Stock Paid in Capital Retained Earnings 13,000 18,000 31,000 3,500 46,000 6,000 10,500 Total Assets 133,800 Total Equity Total Liabilities and Owners' Equity 78,000 133,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts