Question: Can some please please please help me? I AM so lost Dollar Amount Savings per Year Rate of Return Number of Years Future Value of

Can some please please please help me? I AM so lost

Can some please please please help me? I AM so lost

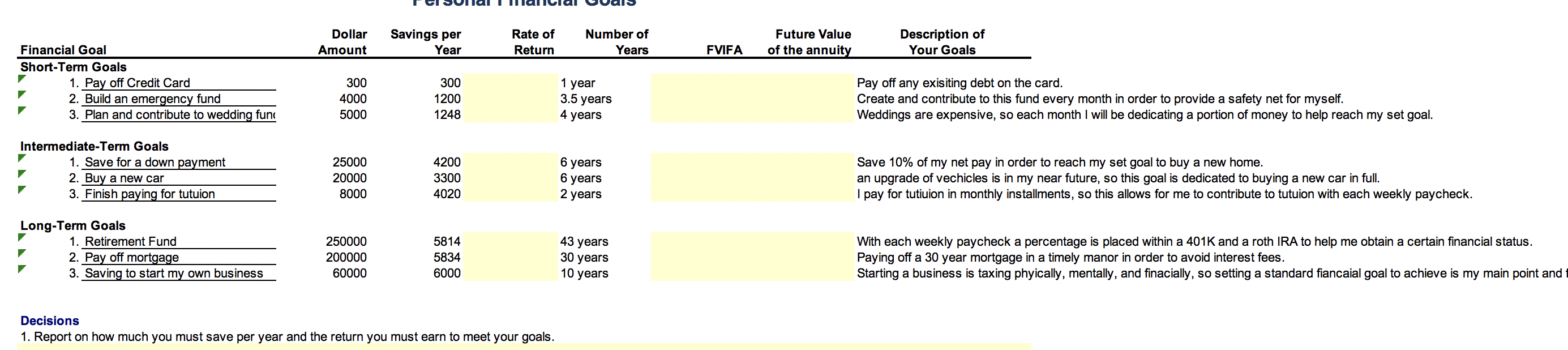

Dollar Amount Savings per Year Rate of Return Number of Years Future Value of the annuity Description of Your Goals FVIFA Financial Goal Short-Term Goals 1. Pay off Credit Card 2. Build an emergency fund 3. Plan and contribute to wedding fun 300 4000 5000 300 1200 1248 1 year 3.5 years 4 years Pay off any exisiting debt on the card. Create and contribute to this fund every month in order to provide a safety net for myself. Weddings are expensive, so each month I will be dedicating a portion of money to help reach my set goal. Intermediate-Term Goals 1. Save for a down payment 2. Buy a new car 3. Finish paying for tutuion 25000 20000 8000 4200 3300 4020 6 years 6 years Save 10% of my net pay in order to reach my set goal to buy a new home. an upgrade of vechicles is in my near future, so this goal is dedicated to buying a new car in full. I pay for tutiuion in monthly installments, so this allows for me to contribute to tutuion with each weekly paycheck. 2 years Long-Term Goals 1. Retirement Fund 2. Pay off mortgage 3. Saving to start my own business 250000 200000 60000 5814 5834 6000 43 years 30 years 10 years With each weekly paycheck a percentage is placed within a 401K and a roth IRA to help me obtain a certain financial status. Paying off a 30 year mortgage in a timely manor in order to avoid interest fees. Starting a business is taxing phyically, mentally, and finacially, so setting a standard fiancaial goal to achieve is my main point and Decisions 1. Report on how much you must save per year and the return you must earn to meet your goals. Dollar Amount Savings per Year Rate of Return Number of Years Future Value of the annuity Description of Your Goals FVIFA Financial Goal Short-Term Goals 1. Pay off Credit Card 2. Build an emergency fund 3. Plan and contribute to wedding fun 300 4000 5000 300 1200 1248 1 year 3.5 years 4 years Pay off any exisiting debt on the card. Create and contribute to this fund every month in order to provide a safety net for myself. Weddings are expensive, so each month I will be dedicating a portion of money to help reach my set goal. Intermediate-Term Goals 1. Save for a down payment 2. Buy a new car 3. Finish paying for tutuion 25000 20000 8000 4200 3300 4020 6 years 6 years Save 10% of my net pay in order to reach my set goal to buy a new home. an upgrade of vechicles is in my near future, so this goal is dedicated to buying a new car in full. I pay for tutiuion in monthly installments, so this allows for me to contribute to tutuion with each weekly paycheck. 2 years Long-Term Goals 1. Retirement Fund 2. Pay off mortgage 3. Saving to start my own business 250000 200000 60000 5814 5834 6000 43 years 30 years 10 years With each weekly paycheck a percentage is placed within a 401K and a roth IRA to help me obtain a certain financial status. Paying off a 30 year mortgage in a timely manor in order to avoid interest fees. Starting a business is taxing phyically, mentally, and finacially, so setting a standard fiancaial goal to achieve is my main point and Decisions 1. Report on how much you must save per year and the return you must earn to meet your goals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts