Question: Can somebody detect my mistake? Somehow I got it wrong... :( Assume Gillette Corporation will pay an annual dividend of $0.66 one year from now.

Can somebody detect my mistake? Somehow I got it wrong... :(

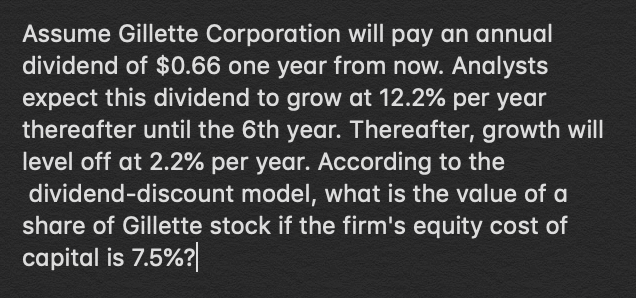

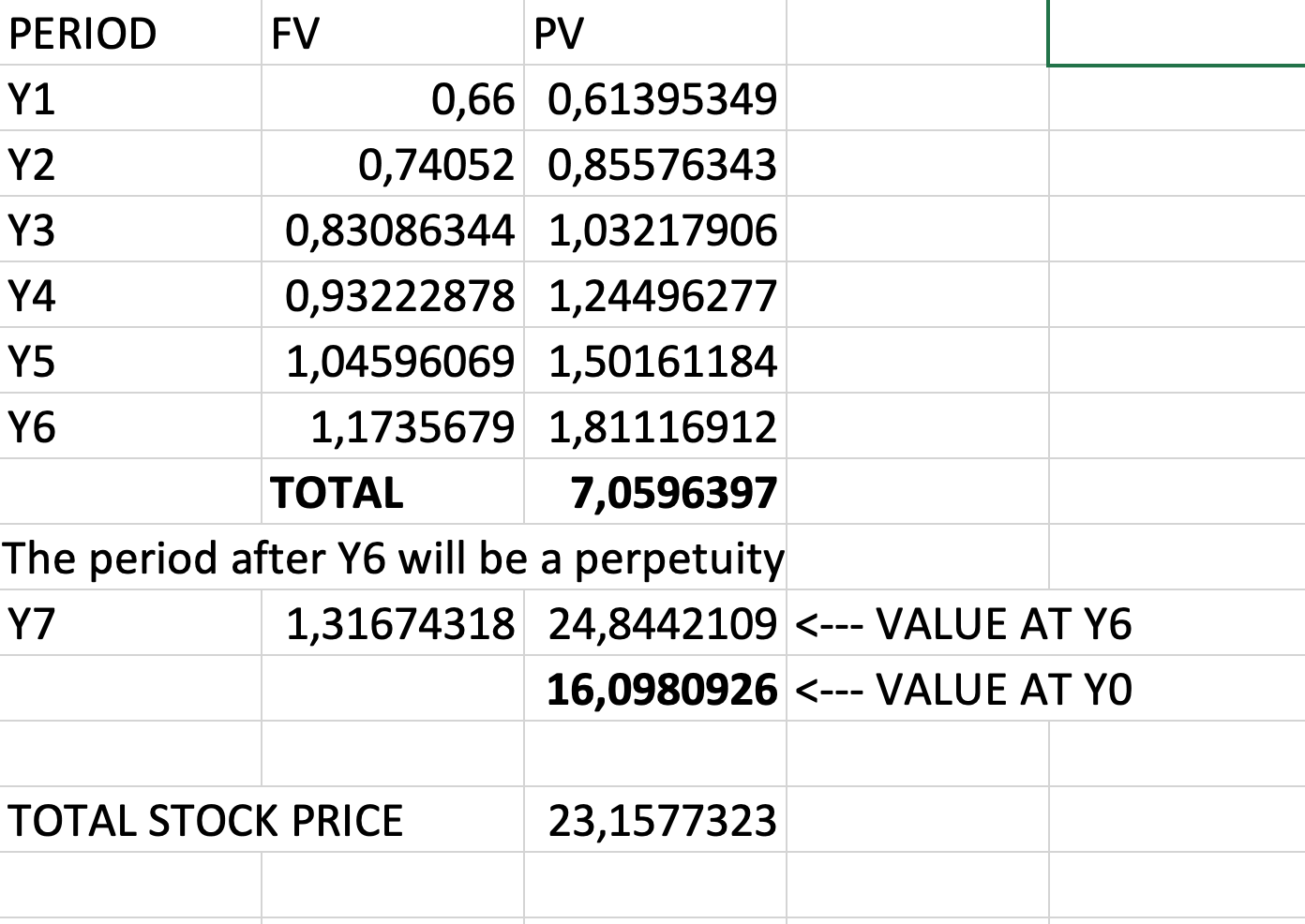

Assume Gillette Corporation will pay an annual dividend of $0.66 one year from now. Analysts expect this dividend to grow at 12.2% per year thereafter until the 6th year. Thereafter, growth will level off at 2.2% per year. According to the dividend-discount model, what is the value of a share of Gillette stock if the firm's equity cost of capital is 7.5%? PERIOD FV PV Y1 0,66 0,61395349 Y2 0,74052 0,85576343 Y3 0,83086344 1,03217906 Y4 0,93222878 1,24496277 Y5 1,04596069 1,50161184 Y6 1,1735679 1,81116912 TOTAL 7,0596397 The period after Y6 will be a perpetuity YZ 1,31674318 24,8442109

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts