Question: Can somebody do this and show their work because I'm confused, thank you. ABC Music, Inc. projects following unit sales for new Bluetooth speakers: Year

Can somebody do this and show their work because I'm confused, thank you.

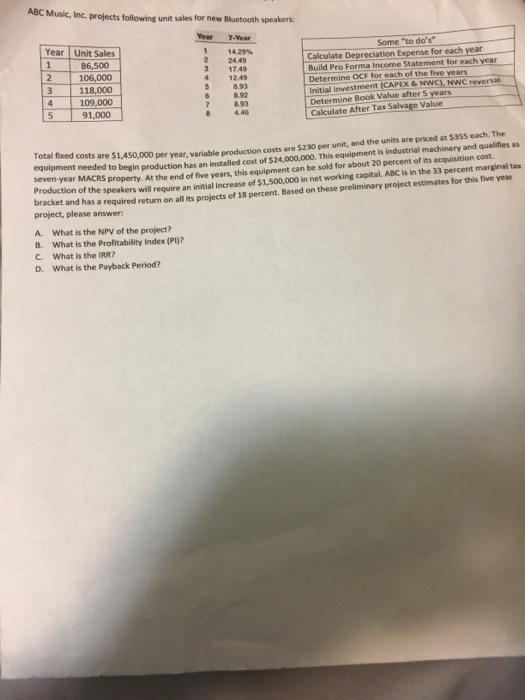

ABC Music, Inc. projects following unit sales for new Bluetooth speakers: Year 7.Year Year Unit Sales Some to do's 1429% 2 24.49 3 17.49 4 12.49 8.93 8.92 8.93 4.46 Calculate Depreciation Expense for each year Build Pro Forma Income Statement for each year Determine OCF for each of the five years Initial investment (CAPEx & NWC) NWC reversal Determine Book Value after S years Calculate After Tax Salvage Value 86,500 106,000 3 118,000 4 109,000 591,000 and the units are priced at $355 each. The Total fixed costs are $1,450,000 per year, variable production costs are $230 per unit, equipment needed to begin arn production has an installed cost of $24,000,000. This equipment is industrial At the end of five years, this equipment can be sold for about 20 percent of its acquisition cost machinery and qualifiles as 33 percent marginal tax Production of the speakers will require an initial increase of $1,500,000 in net working capital. ABC is in the 18 percent. Based on these preliminary project estimates for this five year bracket and has a required return on all its projects of project, please answer A. B. C. What is the NPV of the project? What is the Profitability Index (PI)? What is the IRR? D. What is the Payback Period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts