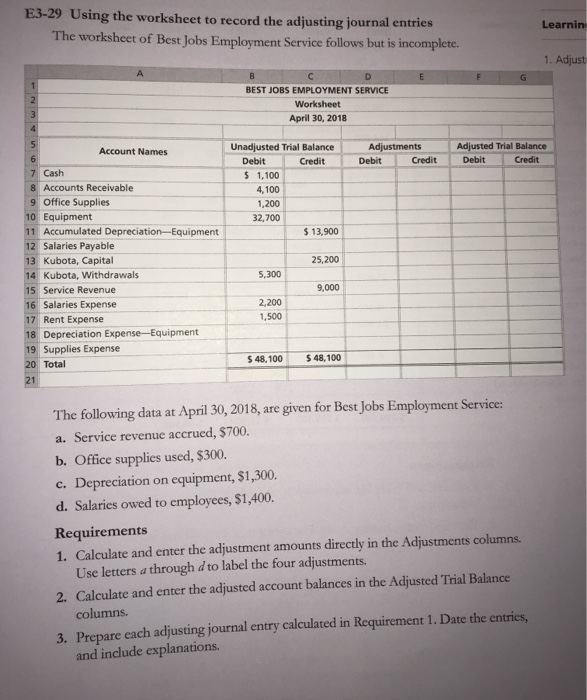

Question: Can somebody help me with 29? E3-29 Using the worksheet to record the adjusting journal entries The worksheet of Best Jobs Employment Service follows but

E3-29 Using the worksheet to record the adjusting journal entries The worksheet of Best Jobs Employment Service follows but is Learnin incomplete 1. Adjust A E D G BEST JOBS EMPLOYMENT SERVICE Worksheet 3 April 30, 2018 5 Adjusted Trial Balance Adjustments Unadjusted Trial Balance Account Names 6 Debit Credit Debit Credit Debit Credit 7 Cash 8 Accounts Receivable 9 Office Supplies 10 Equipment $ 1,100 4,100 1,200 32,700 Accumulated Dep 1 ion-Equipment $13,900 12 Salaries Payable 13 Kubota, Capital 14 Kubota, Withdrawals 15 Service Revenue 16 Salaries Expense 17 Rent Expense 18 Depreciation Expense-Equipment 19 Supplies Expense 20 Total 25,200 5,300 9,000 2.200 1,500 $ 48,100 S 48,100 21 given for Best Jobs Employment Service: April 30, 2018, are The following data at a. Service revenue accrued, $700. b. Office supplies used, $300. Depreciation on equipment, $1,300. d. Salaries owed to employees, $1,400. c. Requirements 1. Calculate and enter the adjustment amounts Use letters a through d to label the four adjustments directly in the Adjustments columns. 2. Calculate and enter the adjusted account balances in the Adjusted Trial Balance 3. Prepare each adjusting journal entry calculated in Requirement 1. Date the entries, and include explanations. columns. -Nm n oN00 av

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts