Question: Can somebody help me with this problem? Thank you! Consider the asset approach to exchange rates (our theory to determine short run exchange rates) for

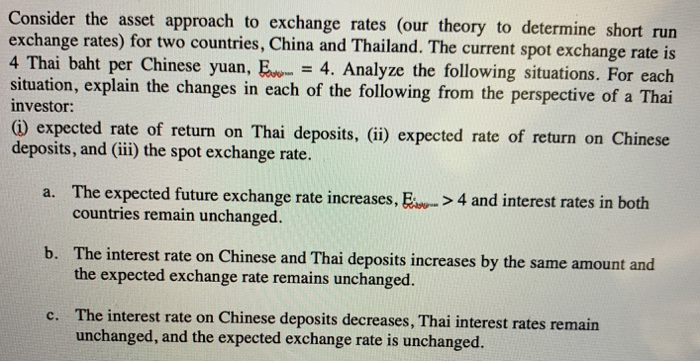

Consider the asset approach to exchange rates (our theory to determine short run exchange rates) for two countries, China and Thailand. The current spot exchange rate is 4 Thai baht per Chinese yuan, E 4. Analyze the following situations. For e situation, explain the changes in each of the following from the perspective of a Thai investor: expected rate of return on Thai deposits, (ii) expected rate of return on Chinese deposits, and(iii) the spot exchange rate. a. The expecte d future exchange rate increases, 4 and interest rates in both countries remain unchanged. The interest rate on Chinese and Thai deposits increases by the same amount and the expected exchange rate remains unchanged. b. The interest rate on Chinese deposits decreases, Thai interest rates remain unchanged, and the expected exchange rate is unchanged. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts