Question: Can somebody please help me with the following problem. Please show me the process using formulas or Calculator Silver Stores uses common stock equity and

Can somebody please help me with the following problem.

Please show me the process using formulas or Calculator

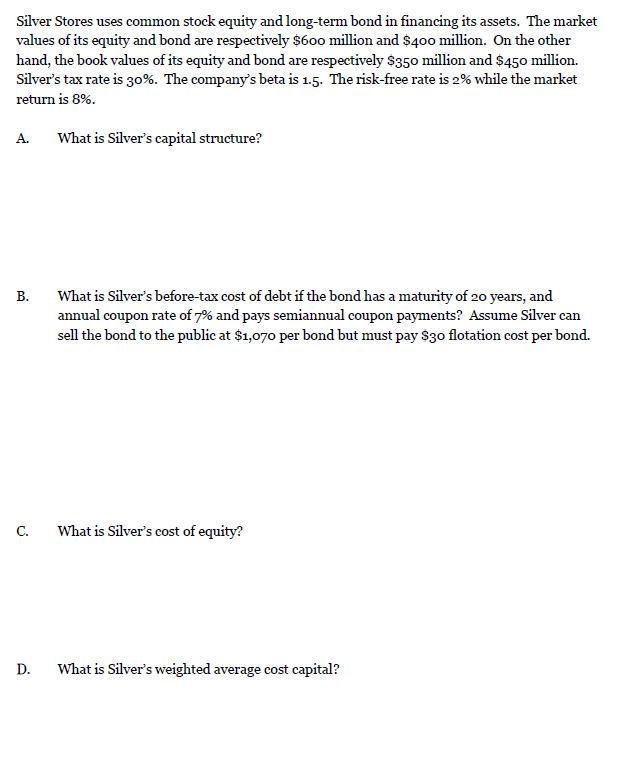

Silver Stores uses common stock equity and long-term bond in financing its assets. The market values of its equity and bond are respectively $600 million and $400 million. On the other hand, the book values of its equity and bond are respectively $350 million and $450 million. Silver's tax rate is 30%. The company's beta is 1.5. The risk-free rate is2%while the market return is8%. What is Silver's capital structure? What is Silver's before-tax cost of debt if the bond has a maturity of 20 years, and annual coupon rate of7%and pays semiannual coupon payments? Assume Silver can sell the bond to the public at $1, 070 per bond but must pay $30 flotation cost per bond. What is Silver's cost of equity? What is Silver's weighted average cost capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts