Question: Can someone also explain how to do c? Cash conversion cycle American Products is concerned about managing cash efficiently. On the average, inventories have an

Can someone also explain how to do c?

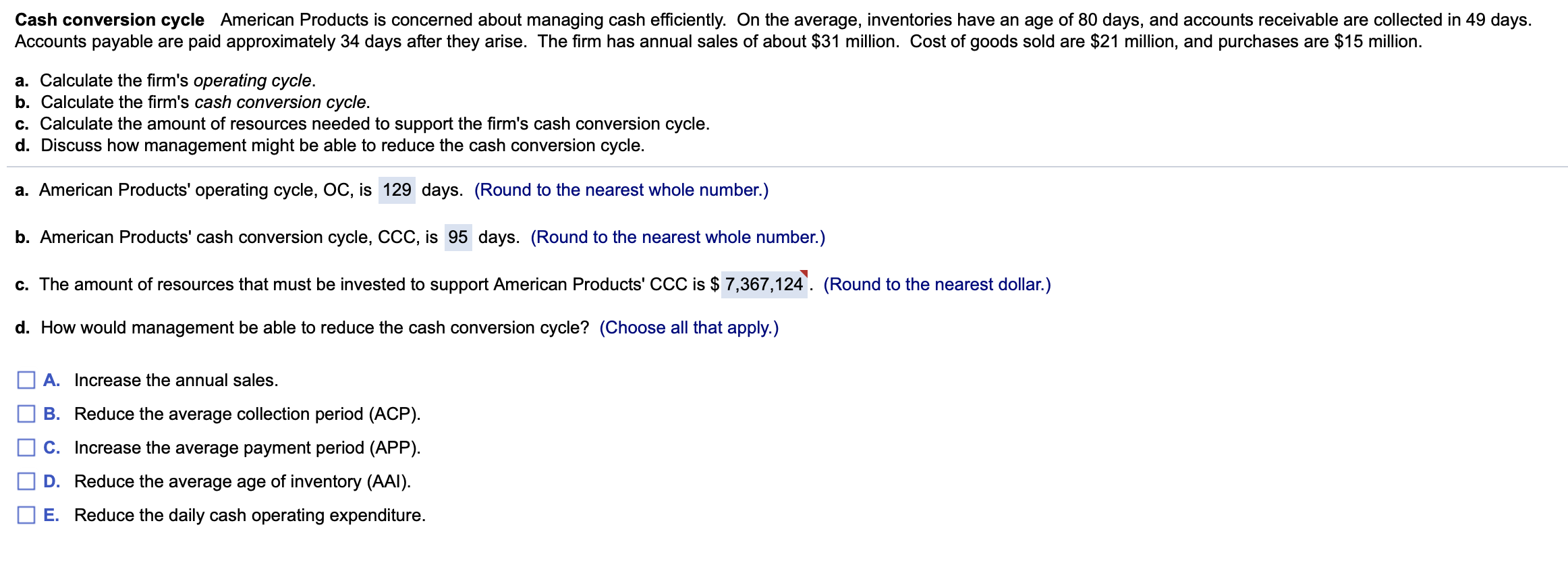

Cash conversion cycle American Products is concerned about managing cash efficiently. On the average, inventories have an age of 80 days, and accounts receivable are collected in 49 days. Accounts payable are paid approximately 34 days after they arise. The firm has annual sales of about $31 million. Cost of goods sold are $21 million, and purchases are $15 million. a. Calculate the firm's operating cycle. b. Calculate the firm's cash conversion cycle. c. Calculate the amount of resources needed to support the firm's cash conversion cycle. d. Discuss how management might be able to reduce the cash conversion cycle. a. American Products' operating cycle, OC, is 129 days. (Round to the nearest whole number.) b. American Products' cash conversion cycle, CCC, is 95 days. (Round to the nearest whole number.) C. The amount of resources that must be invested to support American Products' CCC is $ 7,367,124. (Round to the nearest dollar.) d. How would management be able to reduce the cash conversion cycle? (Choose all that apply.) A. Increase the annual sales. B. Reduce the average collection period (ACP). C. Increase the average payment period (APP). D. Reduce the average age of inventory (AAI). E. Reduce the daily cash operating expenditure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts