Question: Can someone answer please 100% correct? This is complete information Hula Enterprises is considering finance manager wishes to find an appropriate risk adjusted discount rate

Can someone answer please 100% correct?

This is complete information

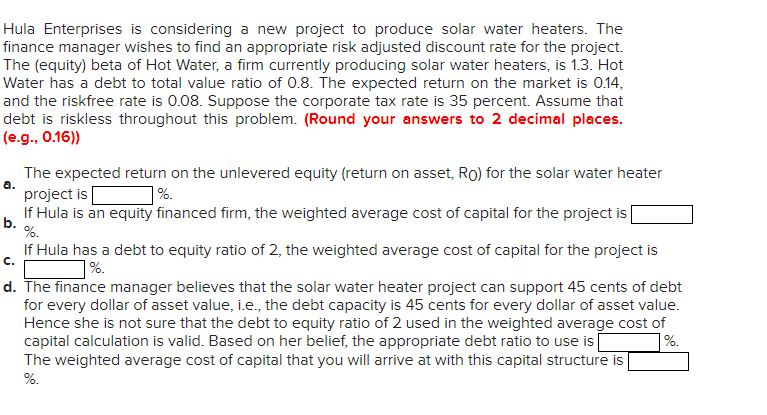

Hula Enterprises is considering finance manager wishes to find an appropriate risk adjusted discount rate for the project. The (equity) beta of Hot Water, a firm currently producing solar water heaters, is 1.3. Hot Water has a debt to total value ratio of 0.8. The expected return on the market is 0.14 and the riskfree rate is 0.08. Suppose the corporate tax rate is 35 percent. Assume that debt is riskless throughout this problem. (Round your answers to 2 decimal places. (e.g., 0.16)) a new project to produce solar water heaters. The The expected return on the unlevered equity (return on asset, Ro) for the solar water heater a. project is If Hula is an equity financed firm, the weighted average cost of capital for the project is b. If Hula has a debt to equity ratio of 2, the weighted average cost of capital for the project is C. d. The finance manager believes that the solar water heater project can support 45 cents of debt for every dollar of asset value, i.e., the debt capacity is 45 cents for every dollar of asset value Hence she is not sure that the debt to equity ratio of 2 used in the weighted average cost of capital calculation is valid. Based on her belief, the appropriate debt ratio to use is The weighted average cost of capital that you will arrive at with this capital structure is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts