Question: can someone answer these and explain how they got each answer plus label your numbers so i know where each number is coming from. Please

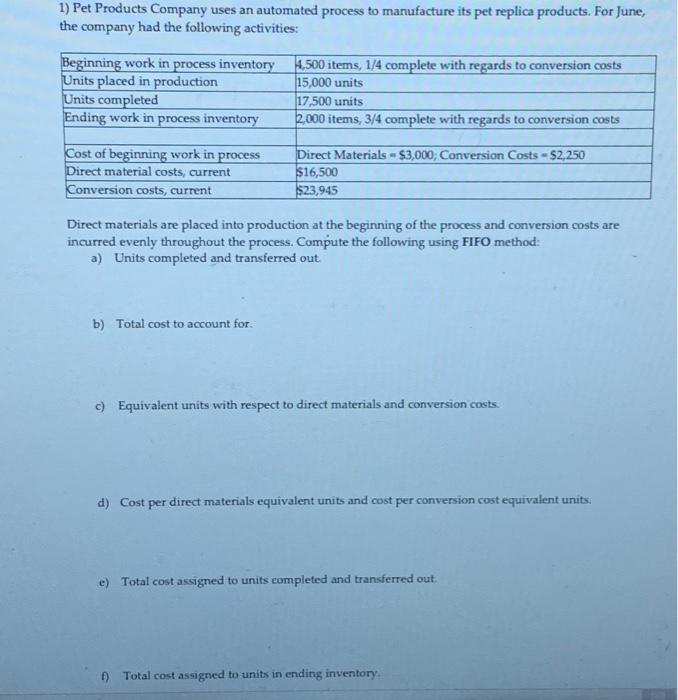

1) Pet Products Company uses an automated process to manufacture its pet replica products. For June, the company had the following activities: Beginning work in process inventory Units placed in production Units completed Ending work in process inventory Cost of beginning work in process Direct material costs, current Conversion costs, current 4,500 items, 1/4 complete with regards to conversion costs 15,000 units: 17,500 units 2,000 items, 3/4 complete with regards to conversion costs Direct Materials $3,000; Conversion Costs $2,250 $16,500 $23,945 Direct materials are placed into production at the beginning of the process and conversion costs are incurred evenly throughout the process. Compute the following using FIFO method: a) Units completed and transferred out. b) Total cost to account for. c) Equivalent units with respect to direct materials and conversion costs. d) Cost per direct materials equivalent units and cost per conversion cost equivalent units. e) Total cost assigned to units completed and transferred out. f) Total cost assigned to units in ending inventory.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts