Question: can someone answer these compul sldlus: QUESTION 25 3.25 points Save Answer Closing entries may involve posting a debit to the Accumulated Depreciation account. Common

can someone answer these

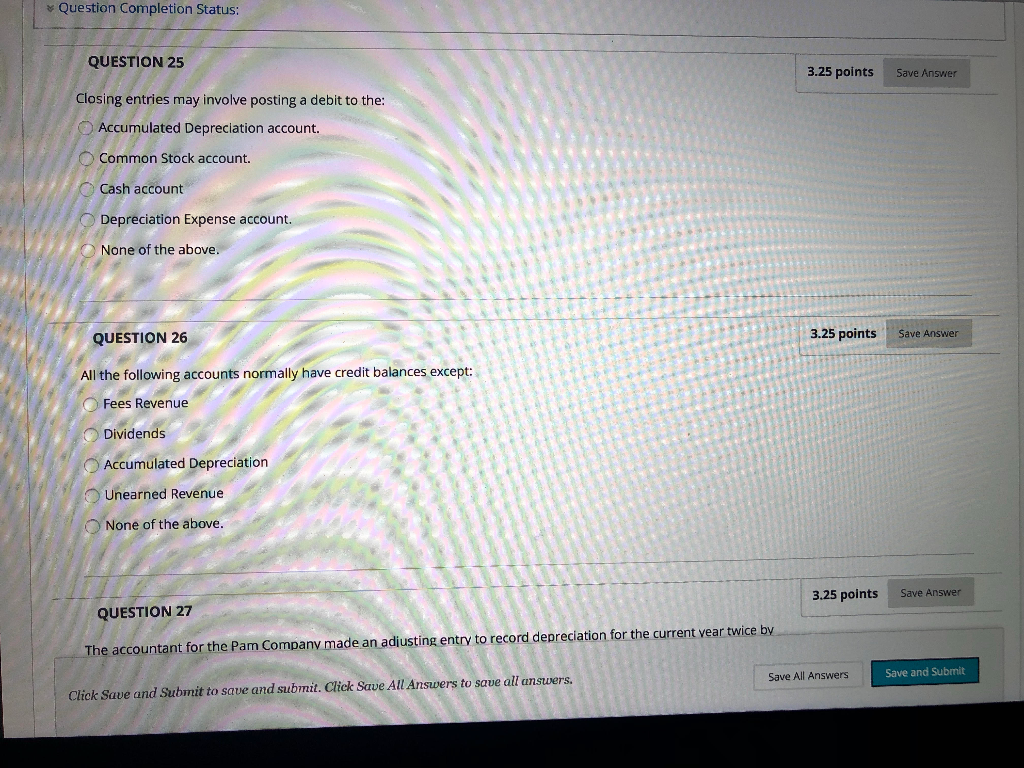

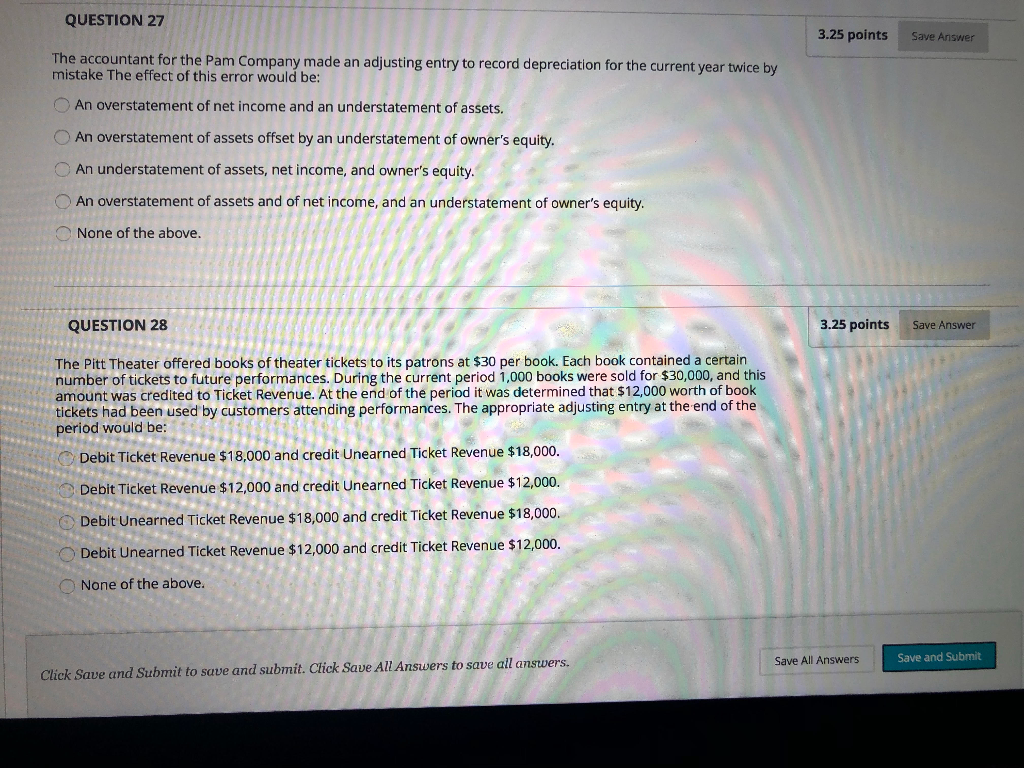

compul sldlus: QUESTION 25 3.25 points Save Answer Closing entries may involve posting a debit to the Accumulated Depreciation account. Common Stock account. Cash account Depreciation Expense account. None of the above. QUESTION 26 3.25 points Save Answer All the following accounts normally have credit balances except: Fees Revenue Dividends Accumulated Depreciation Unearned Revenue None of the above. QUESTION 27 3.25 points Save Answer The accountant for the Pam Company made an adjusting entry to record depreciation for the current year twice by Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit QUESTION 27 3.25 points Save Answer The accountant for the Pam Company made an adjusting entry to record depreciation for the current year twice by mistake The effect of this error would be: An overstatement of net income and an understatement of assets. An overstatement of assets offset by an understatement of owner's equity. An understatement of assets, net income, and owner's equity. An overstatement of assets and of net income, and an understatement of owner's equity. None of the above. QUESTION 28 3.25 points Save Answer The Pitt Theater offered books of theater tickets to its patrons at $30 per book. Each book contained a certain number of tickets to future performances. During the current period 1,000 books were sold for $30,000, and this amount was credited to Ticket Revenue. At the end of the period it was determined that $12,000 worth of book tickets had been used by customers attending performances. The appropriate adjusting entry at the end of the period would be: Debit Ticket Revenue $18,000 and credit Unearned Ticket Revenue $18,000. Debit Ticket Revenue $12,000 and credit Unearned Ticket Revenue $12,000. Debit Unearned Ticket Revenue $18,000 and credit Ticket Revenue $18,000. Debit Unearned Ticket Revenue $12,000 and credit Ticket Revenue $12,000. None of the above. Save All Answers Save and Submit Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts