Question: Can someone answer these two questions for me? With solution. Badly need this asap thank youuuu 1. The balance in James Company's inventory account on

Can someone answer these two questions for me? With solution. Badly need this asap thank youuuu

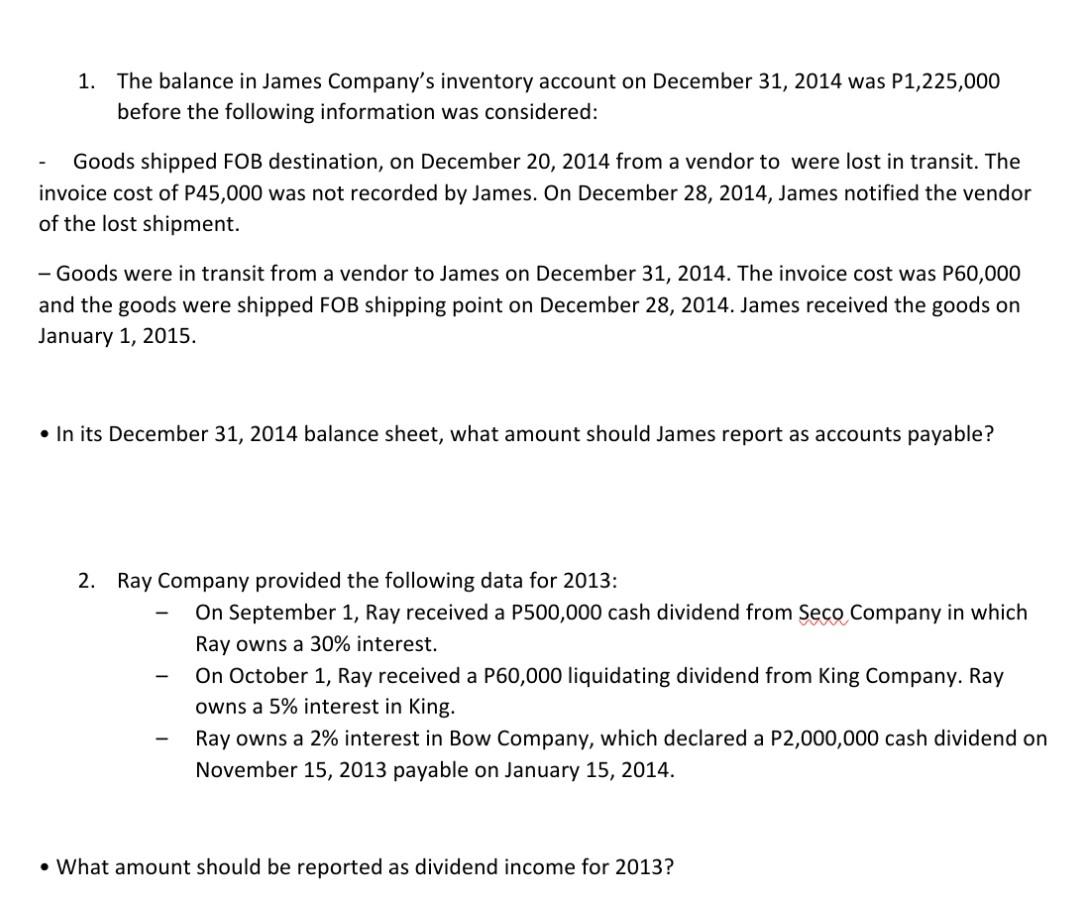

1. The balance in James Company's inventory account on December 31, 2014 was P1,225,000 before the following information was considered: Goods shipped FOB destination, on December 20, 2014 from a vendor to were lost in transit. The invoice cost of P45,000 was not recorded by James. On December 28, 2014, James notified the vendor of the lost shipment. - Goods were in transit from a vendor to James on December 31, 2014. The invoice cost was P60,000 and the goods were shipped FOB shipping point on December 28, 2014. James received the goods on January 1, 2015. In its December 31, 2014 balance sheet, what amount should James report as accounts payable? 2. Ray Company provided the following data for 2013: On September 1, Ray received a P500,000 cash dividend from Seco Company in which Ray owns a 30% interest. On October 1, Ray received a P60,000 liquidating dividend from King Company. Ray owns a 5% interest in King. Ray owns a 2% interest in Bow Company, which declared a P2,000,000 cash dividend on November 15, 2013 payable on January 15, 2014. What amount should be reported as dividend income for 2013

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts