Question: can someone answer this please!!!?? 4. a) How does the cost of a source of capital relate to the valuation concepts? How does the capital

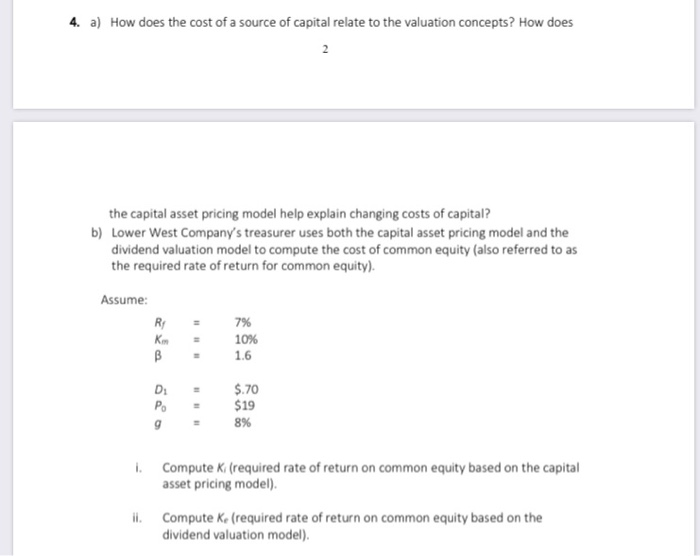

4. a) How does the cost of a source of capital relate to the valuation concepts? How does the capital asset pricing model help explain changing costs of capital? b) Lower West Company's treasurer uses both the capital asset pricing model and the dividend valuation model to compute the cost of common equity (also referred to as the required rate of return for common equity). Assume: R K = $.70 $19 8% i. Compute K (required rate of return on common equity based on the capital asset pricing model). Compute Ke (required rate of return on common equity based on the dividend valuation model)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts