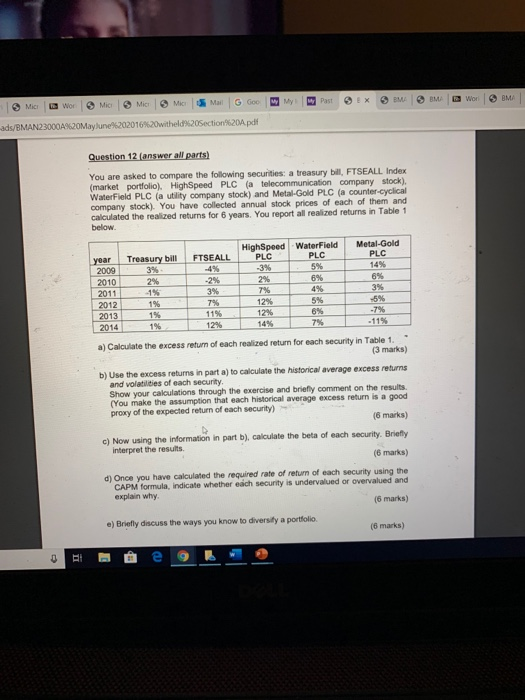

Question: can someone answer this please today? %20A pdf You are asked to compare the following securities: a treasury bill, FTSEALL Index nication company stock). stock)

%20A pdf You are asked to compare the following securities: a treasury bill, FTSEALL Index nication company stock). stock) and Metal-Gold PLC (a counter-cyclical portfolio), HighSpeed PLC (a telecommu WaterField PLC (a utility company company stock). You have collected annual stock prices of each of them and calculated the realized returns for 6 years. You report all realized returns in Table 1 below HighSpeed WaterField Metal-Gold PLC PLC year Treasury bill FTSE 14% 6% 4% 5% 6% 2% 4% 1% 156 2010 2011 2012 2013 3% 11% 12% -5% 12% 12% -11% 7% 14% 1% 2014) a) Calculate the excess retum of each realized return for each security in Table 1 (3 marks) b) Use the excess retuns in part a) to calculate the historical average excess returns and volatilities of each security Show your calculations through the exercise and briefly comment on the results, (You make the assumption that each historical average excess return is a good (8 marks) proxy of the expected return of each security) c) Now using the information in part b), calculate the beta of each security. Briefly (6 marks) interpret the results. d) Once you have calculated the required rate of return of each security using the CAPM formula, indicate whether each security is undervalued or overvalued and explain why (6 marks) e) Briefly discuss the ways you know to diversify a portfolio 6 marks) %20A pdf You are asked to compare the following securities: a treasury bill, FTSEALL Index nication company stock). stock) and Metal-Gold PLC (a counter-cyclical portfolio), HighSpeed PLC (a telecommu WaterField PLC (a utility company company stock). You have collected annual stock prices of each of them and calculated the realized returns for 6 years. You report all realized returns in Table 1 below HighSpeed WaterField Metal-Gold PLC PLC year Treasury bill FTSE 14% 6% 4% 5% 6% 2% 4% 1% 156 2010 2011 2012 2013 3% 11% 12% -5% 12% 12% -11% 7% 14% 1% 2014) a) Calculate the excess retum of each realized return for each security in Table 1 (3 marks) b) Use the excess retuns in part a) to calculate the historical average excess returns and volatilities of each security Show your calculations through the exercise and briefly comment on the results, (You make the assumption that each historical average excess return is a good (8 marks) proxy of the expected return of each security) c) Now using the information in part b), calculate the beta of each security. Briefly (6 marks) interpret the results. d) Once you have calculated the required rate of return of each security using the CAPM formula, indicate whether each security is undervalued or overvalued and explain why (6 marks) e) Briefly discuss the ways you know to diversify a portfolio 6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts