Question: can someone answer this question? I dont know because this question only provided information like this. can anyone help? Suppose you have been hired as

can someone answer this question?

I dont know because this question only provided information like this. can anyone help?

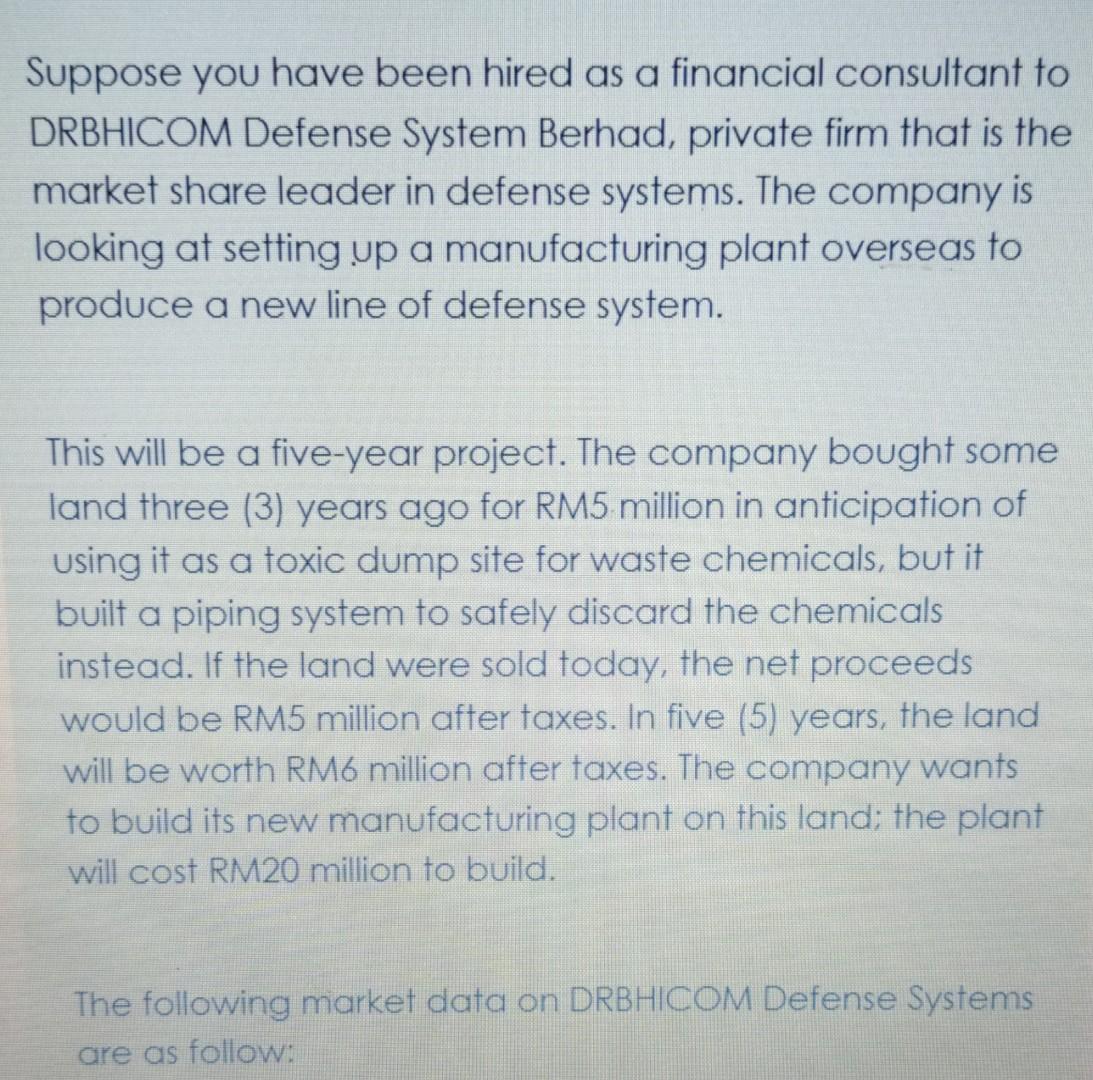

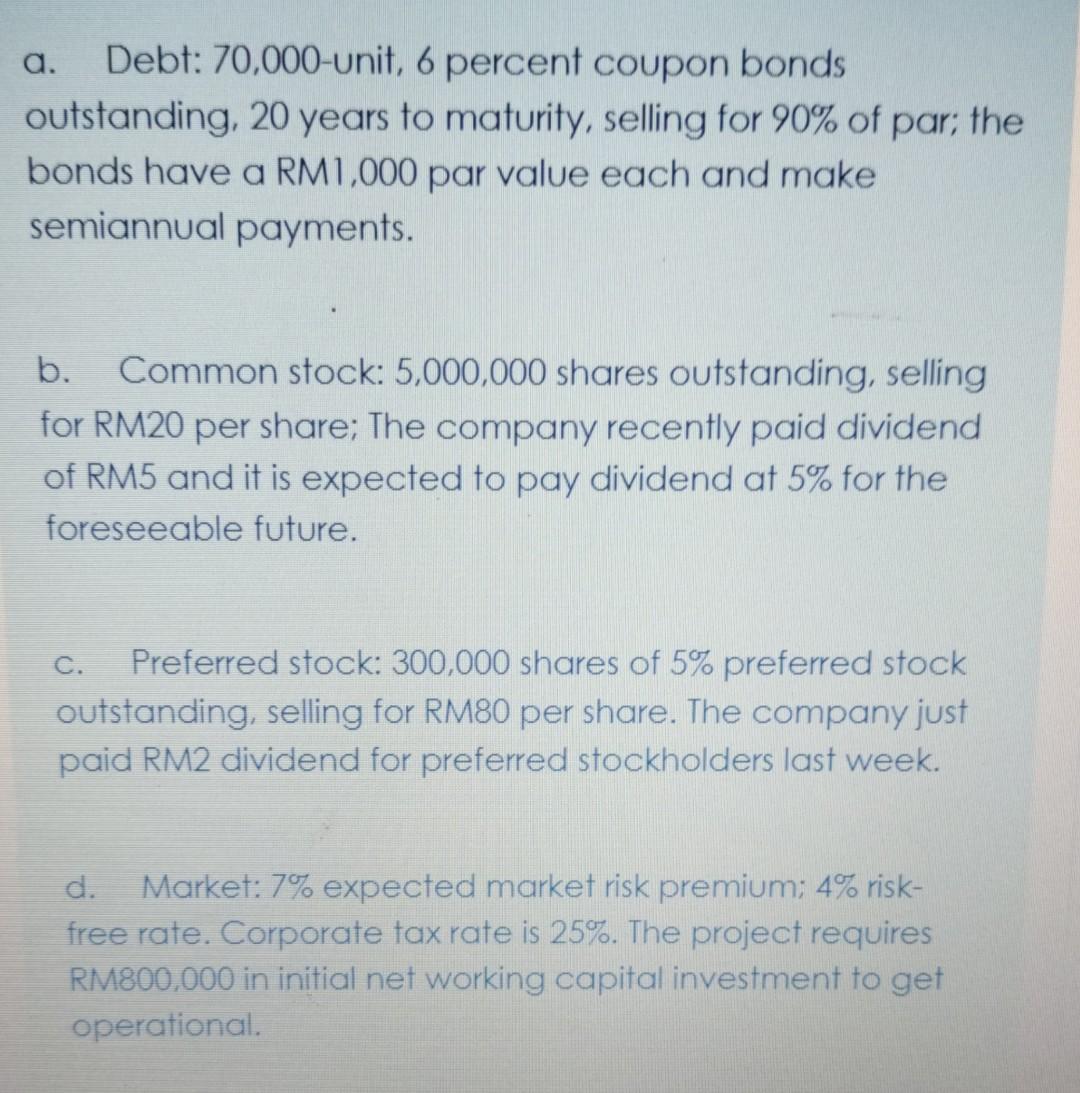

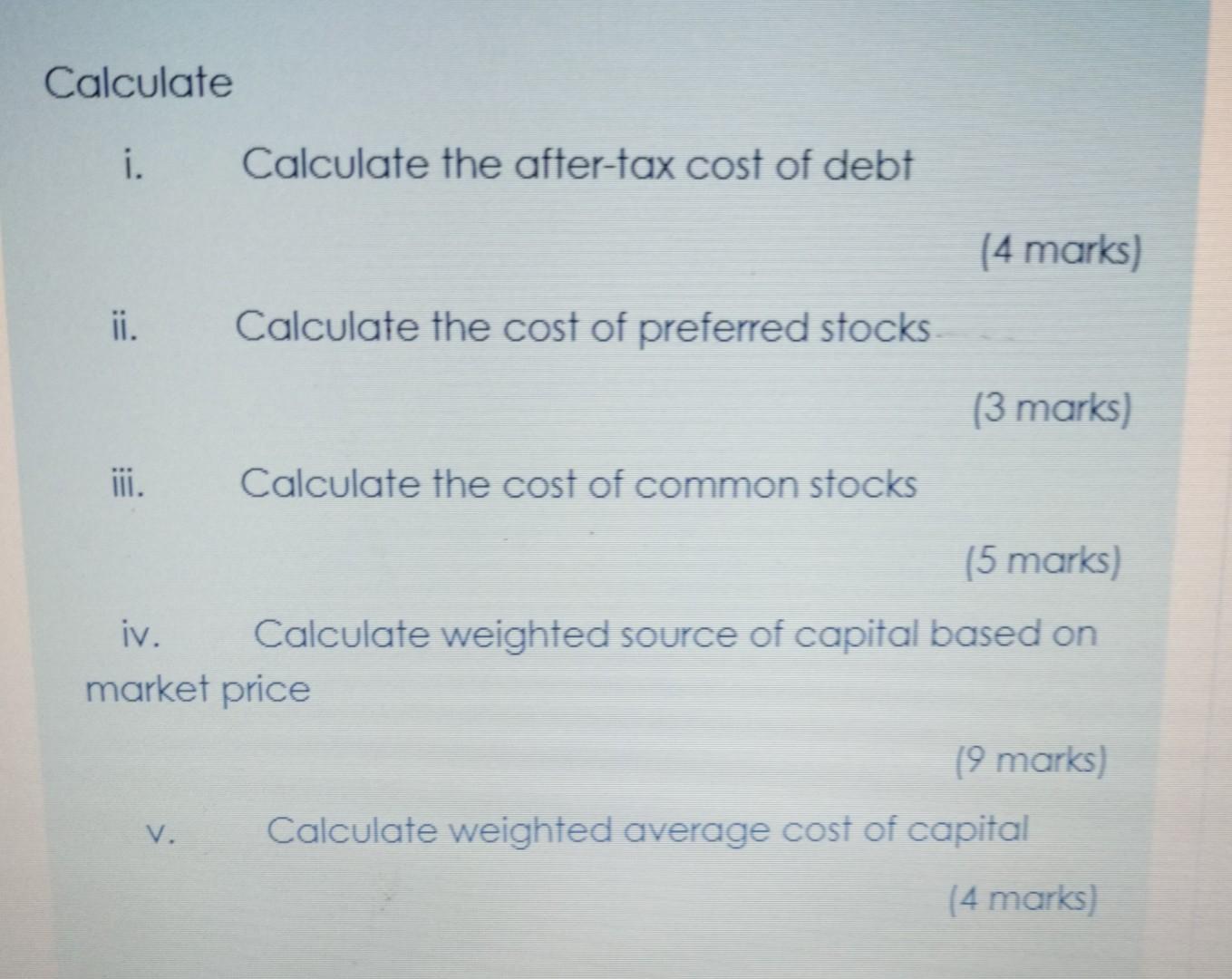

Suppose you have been hired as a financial consultant to DRBHICOM Defense System Berhad, private firm that is the market share leader in defense systems. The company is looking at setting up a manufacturing plant overseas to produce a new line of defense system. This will be a five-year project. The company bought some land three (3) years ago for RM5 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. If the land were sold today, the net proceeds would be RM5 million after taxes. In five (5) years, the land will be worth RM6 million after taxes. The company wants to build its new manufacturing plant on this land: the plant will cost RM20 million to build. The following market data on DRBHICOM Defense Systems are as follow: a. Debt: 70,000-unit, 6 percent coupon bonds outstanding, 20 years to maturity, selling for 90% of par; the bonds have a RM1,000 par value each and make semiannual payments. b. Common stock: 5,000,000 shares outstanding, selling for RM20 per share; The company recently paid dividend of RM5 and it is expected to pay dividend at 5% for the foreseeable future. C. Preferred stock: 300,000 shares of 5% preferred stock outstanding, selling for RM80 per share. The company just paid RM2 dividend for preferred stockholders last week. d. Market: 7% expected market risk premium; 4% risk- free rate. Corporate tax rate is 25%. The project requires RM800,000 in initial net working capital investment to get operational Calculate i. Calculate the after-tax cost of debt (4 marks) ii. Calculate the cost of preferred stocks (3 marks) iii. Calculate the cost of common stocks (5 marks) iv. Calculate weighted source of capital based on market price (9 marks) V. Calculate weighted average cost of capital (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts