Question: Can someone answer this using excel? Question 2a You build a two-asset portfolio by buying shares in Nintendo and selling shares short in Microsoft. For

Can someone answer this using excel?

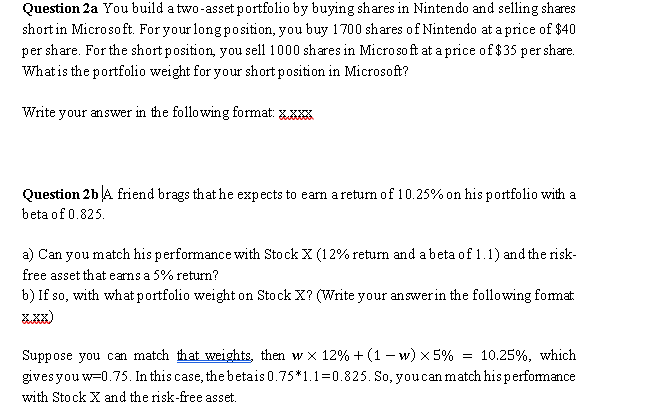

Question 2a You build a two-asset portfolio by buying shares in Nintendo and selling shares short in Microsoft. For your long position, you buy 1700 shares of Nintendo at a price of $40 per share. For the short position, you sell 1000 shares in Microsoft at a price of $35 per share. What is the portfolio weight for your short position in Microsoft? Write your answer in the following format: x xuz Question 2b A friend brags that he expects to earn a return of 10.25% on his portfolio with a beta of 0.825 . a) Can you match his performance with Stock X (12\% return and a beta of 1.1) and the riskfree asset that earns a 5% return? b) If so, with what portfolio weight on Stock X ? (Write your answer in the following format. z,x ) Suppose you can match that weights, then w12%+(1w)5%=10.25%, which gives you w =0.75. In this case, the beta is 0.751.1=0.825. So, you can match his performance with Stock X and the risk-free asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts