Question: Can someone answer this without using excel? thanks Question 05 - Present value Luke Wilkshire and his agent are evaluating three contract options to return

Can someone answer this without using excel? thanks

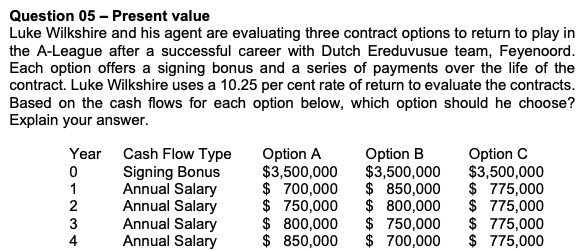

Question 05 - Present value Luke Wilkshire and his agent are evaluating three contract options to return to play in the A-League after a successful career with Dutch Ereduvusue team, Feyenoord. Each option offers a signing bonus and a series of payments over the life of the contract. Luke Wilkshire uses a 10.25 per cent rate of return to evaluate the contracts. Based on the cash flows for each option below, which option should he choose? Explain your answer. AWNO Year Cash Flow Type 0 Signing Bonus Annual Salary 2 Annual Salary 3 Annual Salary 4 Annual Salary Option A $3,500,000 $ 700,000 $ 750,000 $ 800,000 $ 850,000 Option B $3,500,000 $ 850,000 $ 800,000 $ 750,000 $ 700,000 Option C $3,500,000 $ 775,000 $ 775,000 $ 775,000 $ 775,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts