Question: can someone check my second answer, and explain it if possible? thank you Big Walnut Nut Company has the right to buy back its preferred

can someone check my second answer, and explain it if possible? thank you

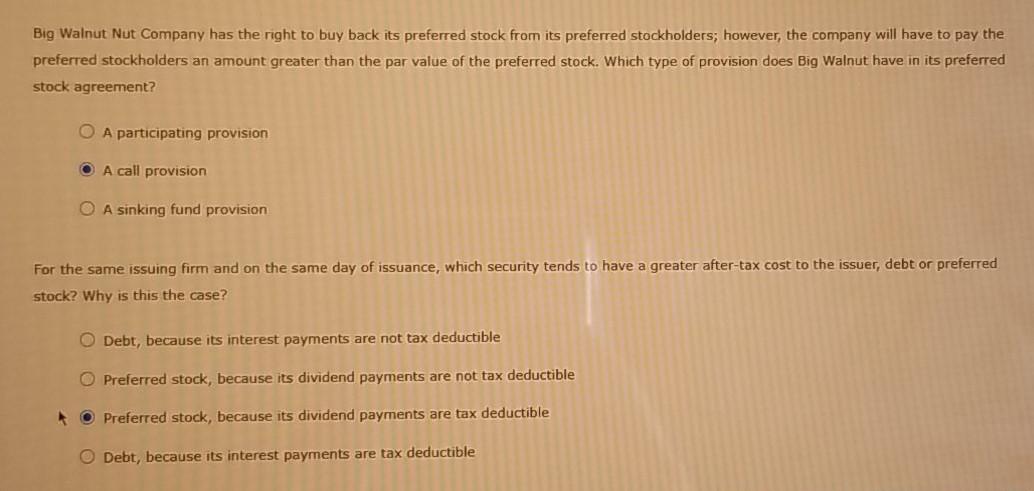

Big Walnut Nut Company has the right to buy back its preferred stock from its preferred stockholders; however, the company will have to pay the preferred stockholders an amount greater than the par value of the preferred stock. Which type of provision does Big Walnut have in its preferred stock agreement? O A participating provision O A call provision O A sinking fund provision For the same issuing firm and on the same day of issuance, which security tends to have a greater after-tax cost to the issuer, debt or preferred stock? Why is this the case? O Debt, because its interest payments are not tax deductible Preferred stock, because its dividend payments are not tax deductible Preferred stock, because its dividend payments are tax deductible Debt, because its interest payments are tax deductible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts