Question: Can someone complete a tax return form with this information: Binu teaches golf lessons at a country club under a business called Binu's Pure Swings

Can someone complete a tax return form with this information:

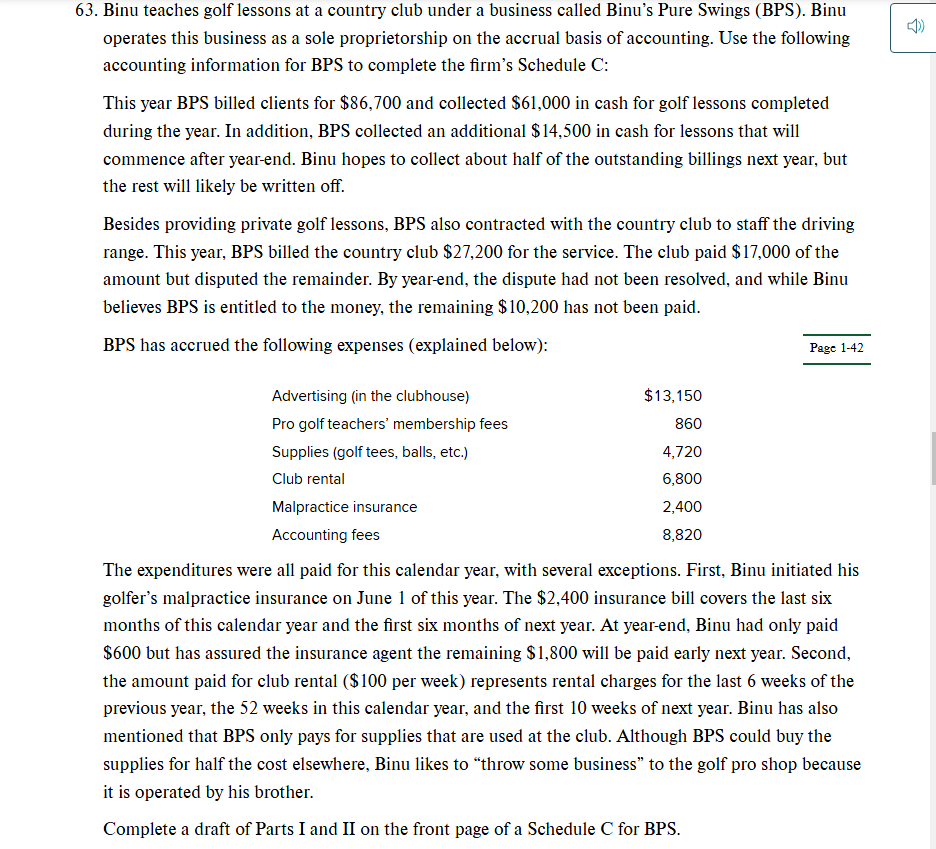

Binu teaches golf lessons at a country club under a business called Binu's Pure Swings BPS Binu

operates this business as a sole proprietorship on the accrual basis of accounting. Use the following

accounting information for BPS to complete the firm's Schedule C:

This year BPS billed clients for $ and collected $ in cash for golf lessons completed

during the year. In addition, BPS collected an additional $ in cash for lessons that will

commence after yearend. Binu hopes to collect about half of the outstanding billings next year, but

the rest will likely be written off.

Besides providing private golf lessons, BPS also contracted with the country club to staff the driving

range. This year, BPS billed the country club $ for the service. The club paid $ of the

amount but disputed the remainder. By yearend, the dispute had not been resolved, and while Binu

believes BPS is entitled to the money, the remaining $ has not been paid.

BPS has accrued the following expenses explained below:

The expenditures were all paid for this calendar year, with several exceptions. First, Binu initiated his

golfer's malpractice insurance on June of this year. The $ insurance bill covers the last six

months of this calendar year and the first six months of next year. At yearend, Binu had only paid

$ but has assured the insurance agent the remaining $ will be paid early next year. Second,

the amount paid for club rental $ per week represents rental charges for the last weeks of the

previous year, the weeks in this calendar year, and the first weeks of next year. Binu has also

mentioned that BPS only pays for supplies that are used at the club. Although BPS could buy the

supplies for half the cost elsewhere, Binu likes to "throw some business" to the golf pro shop because

it is operated by his brother.

Complete a draft of Parts I and II on the front page of a Schedule C for BPS

Under This Form:

Methods used to value closing inventory:

aCost

b Lower of cost or market

c Other attach explanation

Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," attach explanationYesNo

Inventory at beginning of year. If different from last year's closing inventory, attach explanation

Purchases less cost of items withdrawn for personal use

Cost of labor. Do not include any amounts paid to yourself.

Materials and supplies

Other costs.

Add lines through

Inventory at end of year

Cost of goods sold. Subtract line from line Enter the result here and on line

Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line and are not required to file Form for this business. See the instructions for line to find out if you must file Form

When did you place your vehicle in service for business purposes? monthdayyear

Of the total number of miles you drove your vehicle during enter the number of miles you used your vehicle for:

a Business

b Commuting see instructions

c Other

Was your vehicle available for personal use during offduty hours?Yes

Do you or your spouse have another vehicle available for personal use?.Yes No

a Do you have evidence to support your deduction?Yes

No

b If "Yes," is the evidence written? Yes No

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock