Question: Can someone correct any errors in the workings in red (Please show written equations, no excel!) 3. Jason is celebrating his 32th birthday today and

Can someone correct any errors in the workings in red (Please show written equations, no excel!)

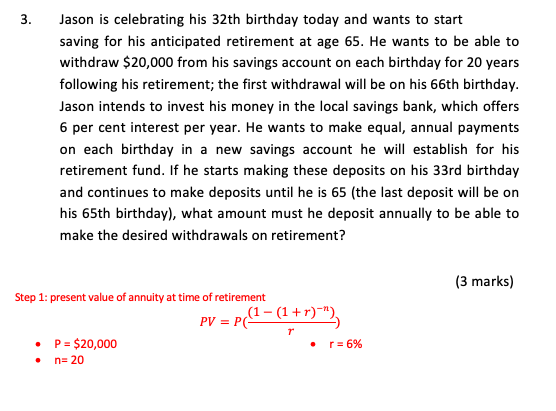

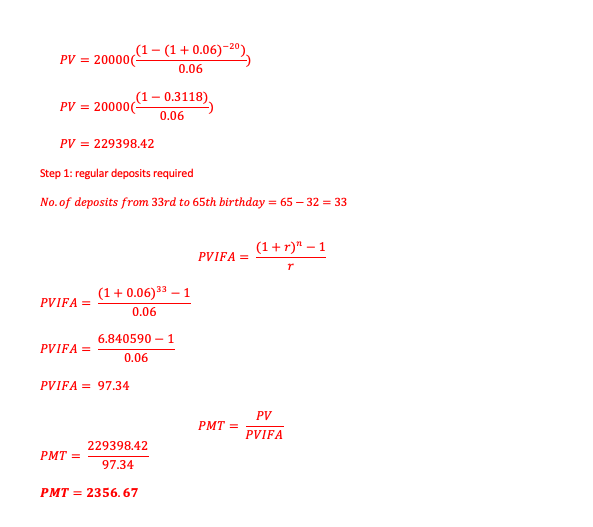

3. Jason is celebrating his 32th birthday today and wants to start saving for his anticipated retirement at age 65. He wants to be able to withdraw $20,000 from his savings account on each birthday for 20 years following his retirement; the first withdrawal will be on his 66th birthday. Jason intends to invest his money in the local savings bank, which offers 6 per cent interest per year. He wants to make equal, annual payments on each birthday in a new savings account he will establish for his retirement fund. If he starts making these deposits on his 33rd birthday and continues to make deposits until he is 65 (the last deposit will be on his 65th birthday), what amount must he deposit annually to be able to make the desired withdrawals on retirement? (3 marks) Step 1: present value of annuity at time of retirement PV = PG (1-(1+r)^") P = $20,000 r = 6% . n= 20 (1 - (1 +0.06)-20) PV = 20000 0.06 (1 -0.3118) PV = 200006 0.06 PV = 229398.42 Step 1: regular deposits required No.of deposits from 33rd to 65th birthday = 65 32 = 33 (1+r)" - 1 PVIFA = r PVIFA= (1 + 0.06)33 - 1 0.06 6.840590 - 1 0.06 PVIFA= PVIFA = 97.34 PV PMT = PVIFA PMT = 229398.42 97.34 PMT = 2356.67

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts