Question: Can someone do the math for the following question - please use the information above to resolve this question. Thank you! Please design hedging strategies

Can someone do the math for the following question - please use the information above to resolve this question. Thank you!

Please design hedging strategies for the firm. You need to explain why your chosen hedging strategies are better than the other strategies.

Design a hedging strategy (6 marks)

Explain why (4 marks)

Please use the following question to help guide you in answering the following question. Thank you!

Please use a mathematical approach to answer these questions and use the above information to give an explanation.

- Convert all the payments into USD dollars for all the payments they are going to receive and they need to make.

- You need to find out if they have to take out money or if there is going to be any extra revenue.

- How much do they have to hedge and what percentage of that can be put into a hedging strategy?

- See that a lot of the payments are coming into 3 to 6 months, they have an immediate need for cash to pay off these suppliers once that is done and how much money is going to come back through?

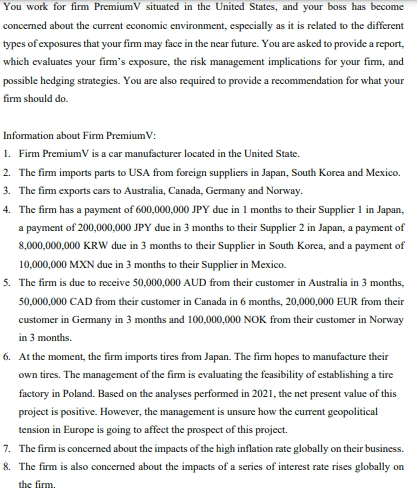

You work for firm PremiumV situated in the United States, and your boss has become concerned about the current economic environment, especially as it is related to the different types of exposures that your firm may face in the near future. You are asked to provide a report, which evaluates your firm's exposure, the risk management implications for your firm, and possible hedging strategies. You are also required to provide a recommendation for what your firm should do. Information about Firm Premium V: 1. Firm PremiumV is a car manufacturer located in the United State. 2. The firm imports parts to USA from foreign suppliers in Japan, South Korea and Mexico. 3. The firm exports cars to Australia, Canada, Germany and Norway. 4. The firm has a payment of 600,000,000 JPY due in 1 months to their Supplier 1 in Japan, a payment of 200,000,000 JPY due in 3 months to their Supplier 2 in Japan, a payment of 8,000,000,000 KRW due in 3 months to their Supplier in South Korea, and a payment of 10,000,000 MXN due in 3 months to their Supplier in Mexico. 5. The firm is due to receive 50,000,000 AUD from their customer in Australia in 3 months, 50,000,000 CAD from their customer in Canada in 6 months, 20,000,000 EUR from their customer in Germany in 3 months and 100,000,000 NOK from their customer in Norway in 3 months. 6. At the moment, the firm imports tires from Japan. The firm hopes to manufacture their own tires. The management of the firm is evaluating the feasibility of establishing a tire factory in Poland. Based on the analyses performed in 2021, the net present value of this project is positive. However, the management is unsure how the current geopolitical tension in Europe is going to affect the prospect of this project. 7. The firm is concerned about the impacts of the high inflation rate globally on their business. 8. The firm is also concerned about the impacts of a series of interest rate rises globally on the firm. You work for firm PremiumV situated in the United States, and your boss has become concerned about the current economic environment, especially as it is related to the different types of exposures that your firm may face in the near future. You are asked to provide a report, which evaluates your firm's exposure, the risk management implications for your firm, and possible hedging strategies. You are also required to provide a recommendation for what your firm should do. Information about Firm Premium V: 1. Firm PremiumV is a car manufacturer located in the United State. 2. The firm imports parts to USA from foreign suppliers in Japan, South Korea and Mexico. 3. The firm exports cars to Australia, Canada, Germany and Norway. 4. The firm has a payment of 600,000,000 JPY due in 1 months to their Supplier 1 in Japan, a payment of 200,000,000 JPY due in 3 months to their Supplier 2 in Japan, a payment of 8,000,000,000 KRW due in 3 months to their Supplier in South Korea, and a payment of 10,000,000 MXN due in 3 months to their Supplier in Mexico. 5. The firm is due to receive 50,000,000 AUD from their customer in Australia in 3 months, 50,000,000 CAD from their customer in Canada in 6 months, 20,000,000 EUR from their customer in Germany in 3 months and 100,000,000 NOK from their customer in Norway in 3 months. 6. At the moment, the firm imports tires from Japan. The firm hopes to manufacture their own tires. The management of the firm is evaluating the feasibility of establishing a tire factory in Poland. Based on the analyses performed in 2021, the net present value of this project is positive. However, the management is unsure how the current geopolitical tension in Europe is going to affect the prospect of this project. 7. The firm is concerned about the impacts of the high inflation rate globally on their business. 8. The firm is also concerned about the impacts of a series of interest rate rises globally on the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts