Question: can someone do this for me ?? Employee Net Pay Kenneth Washington's weekly gross earnings for the week ending March 9 were 52,160, and her

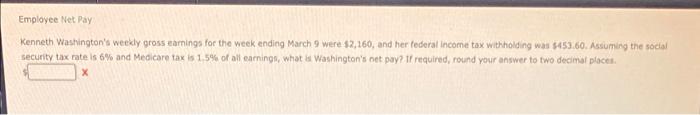

Employee Net Pay Kenneth Washington's weekly gross earnings for the week ending March 9 were 52,160, and her federal income tax withholding was 1453.60. Assuming the social security tax rate is 6% and Medicare tax is 15% of all camino, what a Washington's net pay? If required, round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts