Question: can someone do this for me step by step and explain how u get the new value if retained earning exercise 2 Given the following

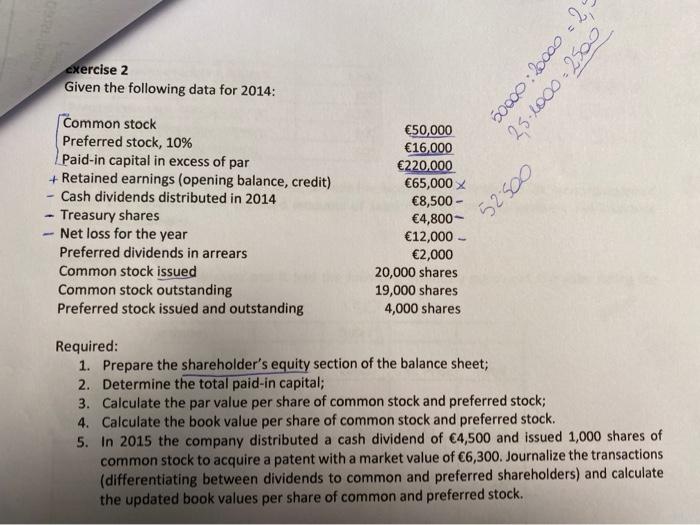

exercise 2 Given the following data for 2014: 50000:2000 = 2, 25.1000-2500 Common stock Preferred stock, 10% Paid-in capital in excess of par + Retained earnings (opening balance, credit) Cash dividends distributed in 2014 - Treasury shares Net loss for the year Preferred dividends in arrears Common stock issued Common stock outstanding Preferred stock issued and outstanding 50,000 16,000 220.000 65,000 8,500 - 4,800 12,000 2,000 20,000 shares 19,000 shares 4,000 shares 52.500 Required: 1. Prepare the shareholder's equity section of the balance sheet; 2. Determine the total paid-in capital; 3. Calculate the par value per share of common stock and preferred stock; 4. Calculate the book value per share of common stock and preferred stock. 5. In 2015 the company distributed a cash dividend of 4,500 and issued 1,000 shares of common stock to acquire a patent with a market value of 6,300. Journalize the transactions (differentiating between dividends to common and preferred shareholders) and calculate the updated book values per share of common and preferred stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts