Question: Can someone explain how he got the .9346 and so on? I was not clear on that part. Thank you. Practice Houston Inc. is valuating

Can someone explain how he got the .9346 and so on? I was not clear on that part.

Thank you.

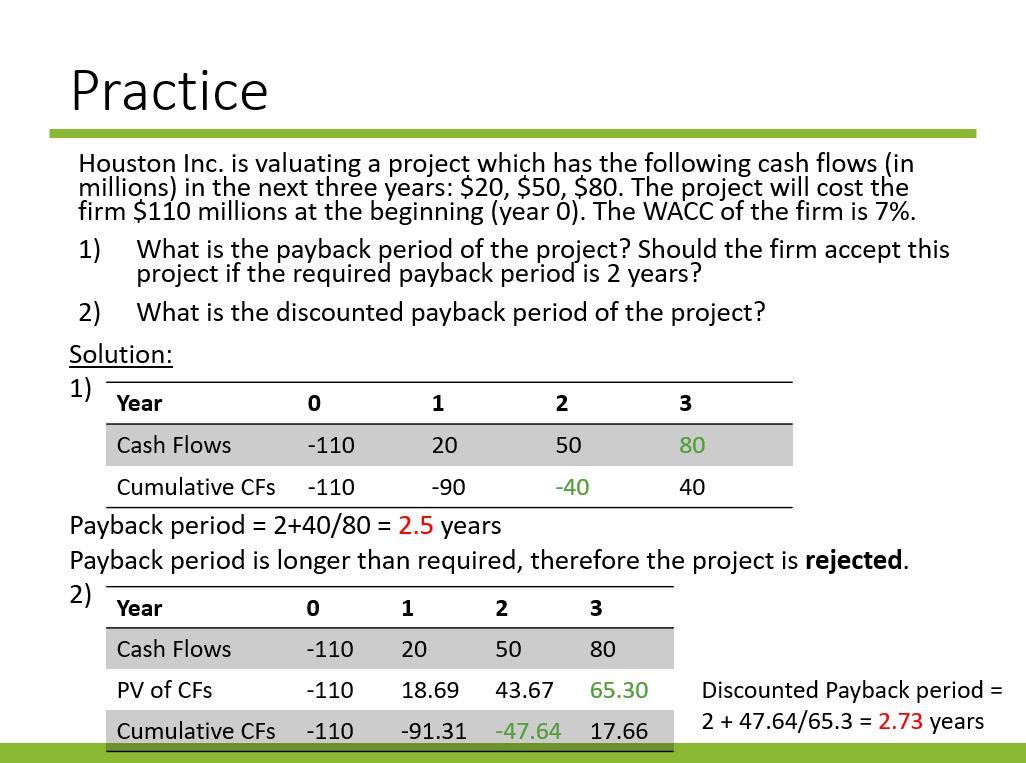

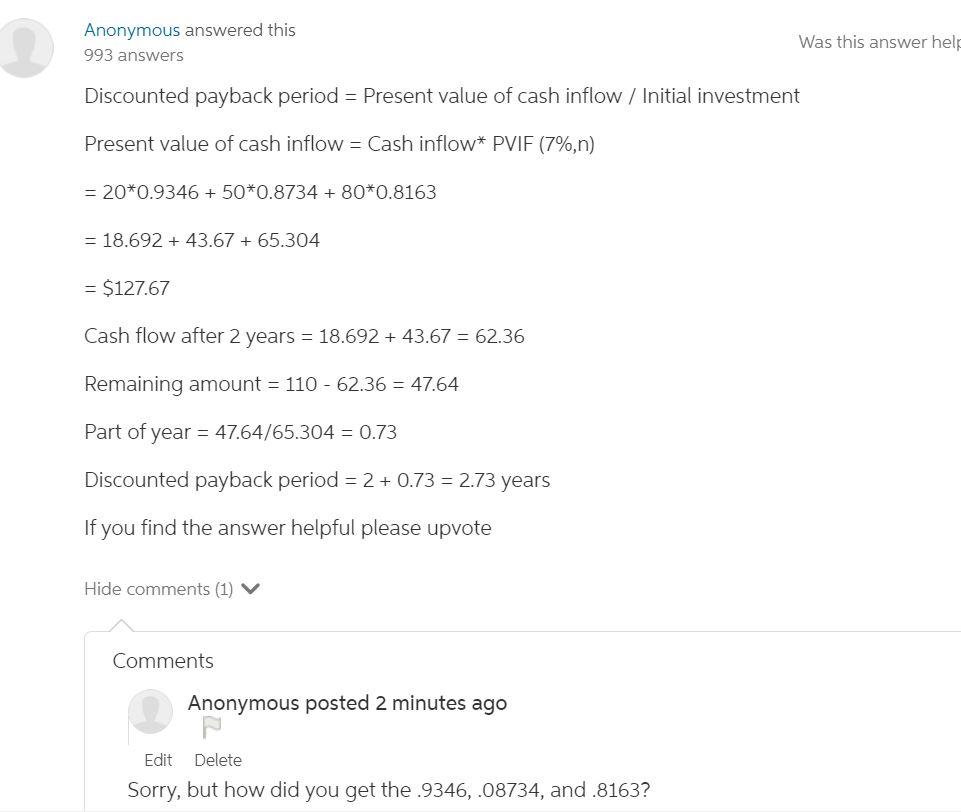

Practice Houston Inc. is valuating a project which has the following cash flows (in millions) in the next three years: $20, $50, $80. The project will cost the firm $110 millions at the beginning (year O). The WACC of the firm is 7%. 1) What is the payback period of the project? Should the firm accept this project if the required payback period is 2 years? 2) What is the discounted payback period of the project? Solution: 1) Year 0 1 2 3 Cash Flows -110 20 50 80 Cumulative CFS -110 -90 -40 40 Payback period = 2+40/80 = 2.5 years Payback period is longer than required, therefore the project is rejected. 2) Year 0 1 2 3 Cash Flows -110 20 50 80 PV of CFs -110 18.69 43.67 65.30 Discounted Payback period 2 + 47.64/65.3 = 2.73 years Cumulative CFs -110 -91.31 -47.64 17.66 Anonymous answered this 993 answers Was this answer help Discounted payback period = Present value of cash inflow / Initial investment Present value of cash inflow = Cash inflow* PVIF (7%,n) = 20*0.9346 + 50*0.8734 + 80*0.8163 = 18.692 + 43.67 + 65.304 = $127.67 Cash flow after 2 years = 18.692 + 43.67 = 62.36 Remaining amount = 110 - 62.36 = 47.64 Part of year = 47.64/65.304 = 0.73 Discounted payback period = 2 + 0.73 = 2.73 years If you find the answer helpful please upvote Hide comments (1) V Comments Anonymous posted 2 minutes ago Edit Delete Sorry, but how did you get the 9346,08734, and .8163

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts