Question: Can someone explain how to get the answer providing formulas and calculations? Thank you 126) During the first two years, ABC drove the company truck

Can someone explain how to get the answer providing formulas and calculations? Thank you

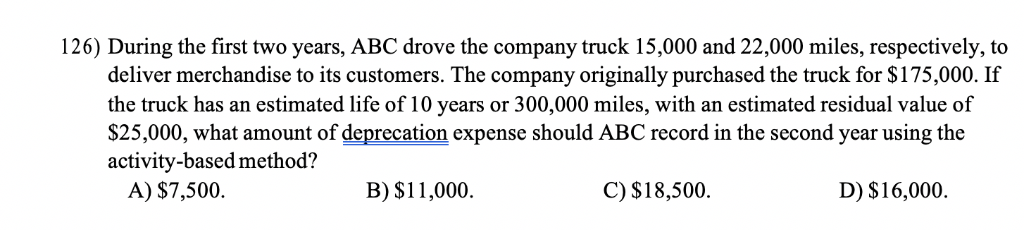

126) During the first two years, ABC drove the company truck 15,000 and 22,000 miles, respectively, to deliver merchandise to its customers. The company originally purchased the truck for $175,000. If the truck has an estimated life of 10 years or 300,000 miles, with an estimated residual value of $25,000, what amount of deprecation expense should ABC record in the second year using the activity-based method? A) $7,500. D) $16,000. B) $11,000. C) $18,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts