Question: Can someone explain how to solve but using the financial calculator please ! (Financial Calculator Only) Metlock Company is negotiating to lease a piece of

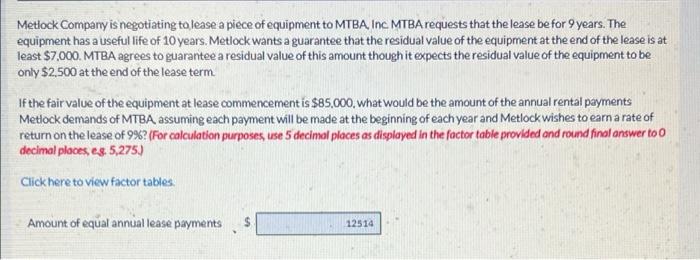

Metlock Company is negotiating to lease a piece of equipment to MTBA, Inc MTBA requests that the lease be for 9 years. The equipment has a useful life of 10 years. Metlock wants a guarantee that the residual value of the equipment at the end of the lease is at least $7,000. MTBA agrees to guarantee a residual value of this amount though it expects the residual value of the equipment to be only $2,500 at the end of the lease term If the fair value of the equipment at lease commencement is $85,000, what would be the amount of the annual rental payments Metlock demands of MTBA, assuming each payment will be made at the beginning of each year and Metlock wishes to earn a rate of return on the lease of 9%? (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer too decimal places, eg. 5,275) Click here to view factor tables Amount of equal annual lease payments $ 12514

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts