Question: Can someone explain how to solve these problems please. Use the following information for Questions 1-8. ABC Company purchased a tractor for $97,000 on July

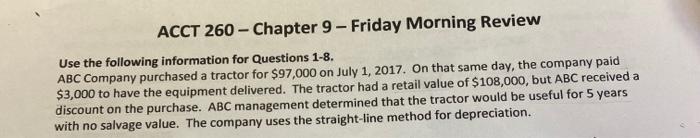

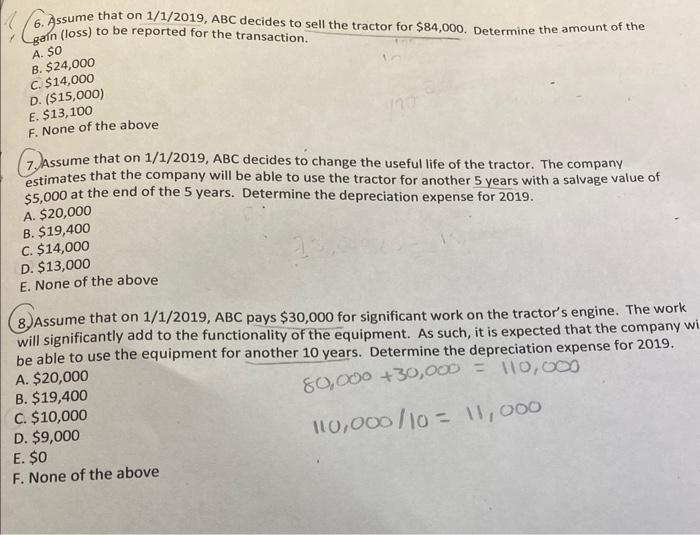

Use the following information for Questions 1-8. ABC Company purchased a tractor for $97,000 on July 1, 2017. On that same day, the company paid $3,000 to have the equipment delivered. The tractor had a retail value of $108,000, but ABC received a discount on the purchase. ABC management determined that the tractor would be useful for 5 years with no salvage value. The company uses the straight-line method for depreciation. 6. Assume that on 1/1/2019,ABC decides to sell the tractor for $84,000. Determine the amount of the gain (loss) to be reported for the transaction. A. $0 B. $24,000 C. $14,000 D. ($15,000) E. $13,100 F. None of the above 7. Assume that on 1/1/2019,ABC decides to change the useful life of the tractor. The company estimates that the company will be able to use the tractor for another 5 years with a salvage value of $5,000 at the end of the 5 years. Determine the depreciation expense for 2019. A. $20,000 B. $19,400 C. $14,000 D. $13,000 E. None of the above 8. Assume that on 1/1/2019, ABC pays $30,000 for significant work on the tractor's engine. The work will significantly add to the functionality of the equipment. As such, it is expected that the company be able to use the equipment for another 10 years. Determine the depreciation expense for 2019. A. $20,000 B. $19,400 80,000+30,000=110,000 C. $10,000 D. $9,000 E. $0 F. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts