Question: Can someone explain how to work this problem step by step using a BA II financial calculator? 12. YIELD TO CALL-It is now January 1,

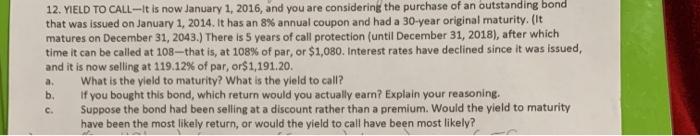

12. YIELD TO CALL-It is now January 1, 2016, and you are considering the purchase of an outstanding bond that was issued on January 1, 2014. It has an 8% annual coupon and had a 30-year original maturity. (It matures on December 31, 2043.) There is 5 years of call protection (until December 31, 2018), after which time it can be called at 108that is, at 108% of par, or $1,080. Interest rates have declined since it was issued, and it is now selling at 119.12% of par, or$1,191.20. a. What is the yield to maturity? What is the yield to call? if you bought this bond, which return would you actually eam? Explain your reasoning. Suppose the bond had been selling at a discount rather than a premium. Would the yield to maturity have been the most likely return, or would the yield to call have been most likely? b. c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts