Question: Can someone explain me how to do this STEP BY STEP with a regular calculator PLEASE and ASAP. THANK YOU!!! 14) Caldwell, Inc. sold an

Can someone explain me how to do this STEP BY STEP with a regular calculator PLEASE and ASAP.

THANK YOU!!!

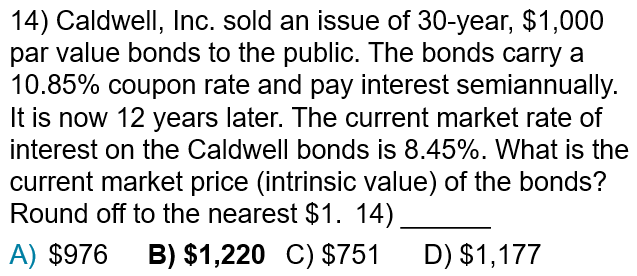

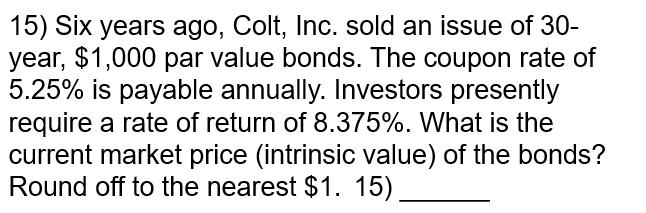

14) Caldwell, Inc. sold an issue of 30-year, $1,000 par value bonds to the public. The bonds carry a 10.85% coupon rate and pay interest semiannually. It is now 12 years later. The current market rate of interest on the Caldwell bonds is 8.45%. What is the current market price (intrinsic value) of the bonds? Round off to the nearest $1. 14). A) $976 B) $1,220 C) $751 D) $1,177 15) Six years ago, Colt, Inc. sold an issue of 30- year, $1,000 par value bonds. The coupon rate of 5.25% is payable annually. Investors presently require a rate of return of 8.375%. What is the current market price (intrinsic value) of the bonds? Round off to the nearest $1. 15)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts