Question: can someone explain or show how they got the expected spot rates here please dian million w you anded to There is also - The

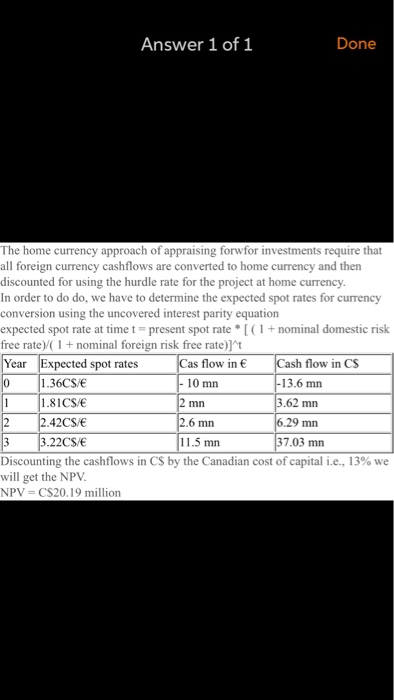

dian million w you anded to There is also - The appropriate ofempial for the company. Based the nel present value (NPV) CEN case di Answer 1 of 1 Done The home currency approach of appraising forwfor investments require that all foreign currency cashflows are converted to home currency and then discounted for using the hurdle rate for the project at home currency. In order to do do, we have to determine the expected spot rates for currency conversion using the uncovered interest parity equation expected spot rate at time t = present spot rate *[(1 + nominal domestic risk free rate) (1 + nominal foreign risk free rate)]^t Year Expected spot rates Cas flow in Cash flow in CS 1.36CS/ - 10 mn -13.6 mn 1.81CS/ 2 mn 3.62 mn 2.42CS/ 2.6 mn 6.29 mn 3.22CS/ 11.5 mm 37.03 mn Discounting the cashflows in CS by the Canadian cost of capital i.e., 13% we will get the NPV. NPV = CS20.19 million dian million w you anded to There is also - The appropriate ofempial for the company. Based the nel present value (NPV) CEN case di Answer 1 of 1 Done The home currency approach of appraising forwfor investments require that all foreign currency cashflows are converted to home currency and then discounted for using the hurdle rate for the project at home currency. In order to do do, we have to determine the expected spot rates for currency conversion using the uncovered interest parity equation expected spot rate at time t = present spot rate *[(1 + nominal domestic risk free rate) (1 + nominal foreign risk free rate)]^t Year Expected spot rates Cas flow in Cash flow in CS 1.36CS/ - 10 mn -13.6 mn 1.81CS/ 2 mn 3.62 mn 2.42CS/ 2.6 mn 6.29 mn 3.22CS/ 11.5 mm 37.03 mn Discounting the cashflows in CS by the Canadian cost of capital i.e., 13% we will get the NPV. NPV = CS20.19 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts