Question: can someone explain the calculation behind ROA i dont quit get it, you can skip ROE, thanks in advance You are an investor of Pepper

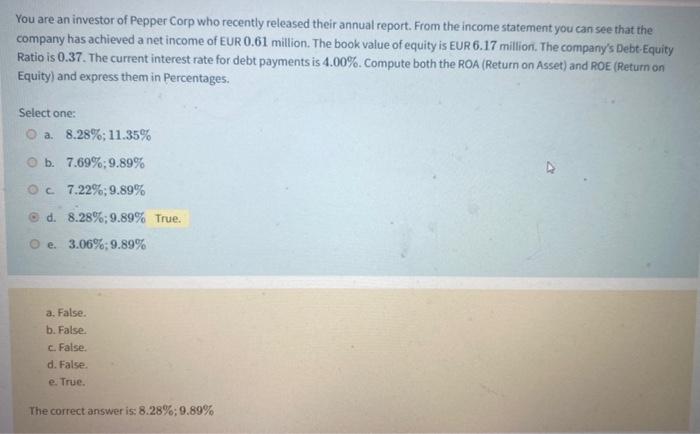

You are an investor of Pepper Corp who recently released their annual report. From the income statement you can see that the company has achieved a net income of EUR 0.61 million. The book value of equity is EUR 6.17 millioni. The company's Debt-Equity Ratio is 0.37. The current interest rate for debt payments is 4.00%. Compute both the ROA (Return on Asset) and ROE (Return on Equity) and express them in Percentages. Select one: a. 8.28%;11.35% b. 7.69%;9.89% C 7.22%;9.89% d. 8.28%;9.89% True. e. 3.06%;9.89% a. False. b. False. c. False. d. False. e. True. The correct answer is: 8.28%;9.89%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts