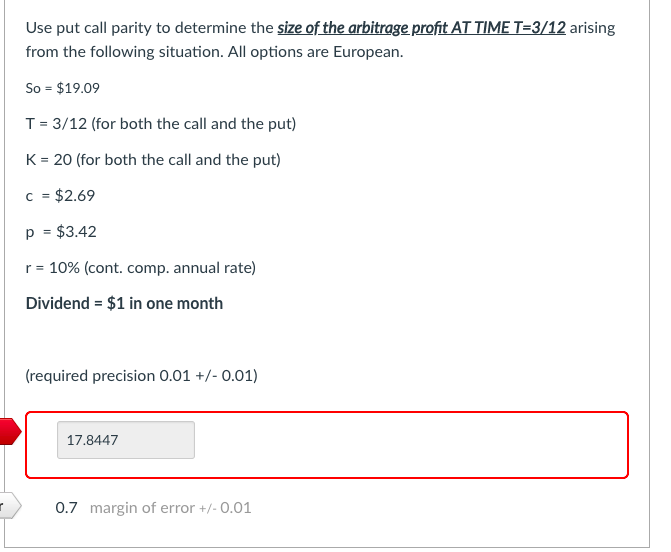

Question: Can someone explain the steps to the answer? Use put call parity to determine the size of the arbitrage profit AT TIME T 3/12 arising

Can someone explain the steps to the answer?

Use put call parity to determine the size of the arbitrage profit AT TIME T 3/12 arising from the following situation. All options are European. So = $19.09 T-3/12 (for both the call and the put K-20 (for both the call and the put) C $2.69 p $3.42 10% (cont. comp. annual rate) Dividend = $1 in one month required precision O.010.01) 17.8447 0.7 margin of error +/-0.01 Use put call parity to determine the size of the arbitrage profit AT TIME T 3/12 arising from the following situation. All options are European. So = $19.09 T-3/12 (for both the call and the put K-20 (for both the call and the put) C $2.69 p $3.42 10% (cont. comp. annual rate) Dividend = $1 in one month required precision O.010.01) 17.8447 0.7 margin of error +/-0.01

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts