Question: Can someone explain this in excel format thank you will rate Tax rates enacted as of the beginning of 2018 are: McEvil's taxable income for

Can someone explain this in excel format thank you will rate

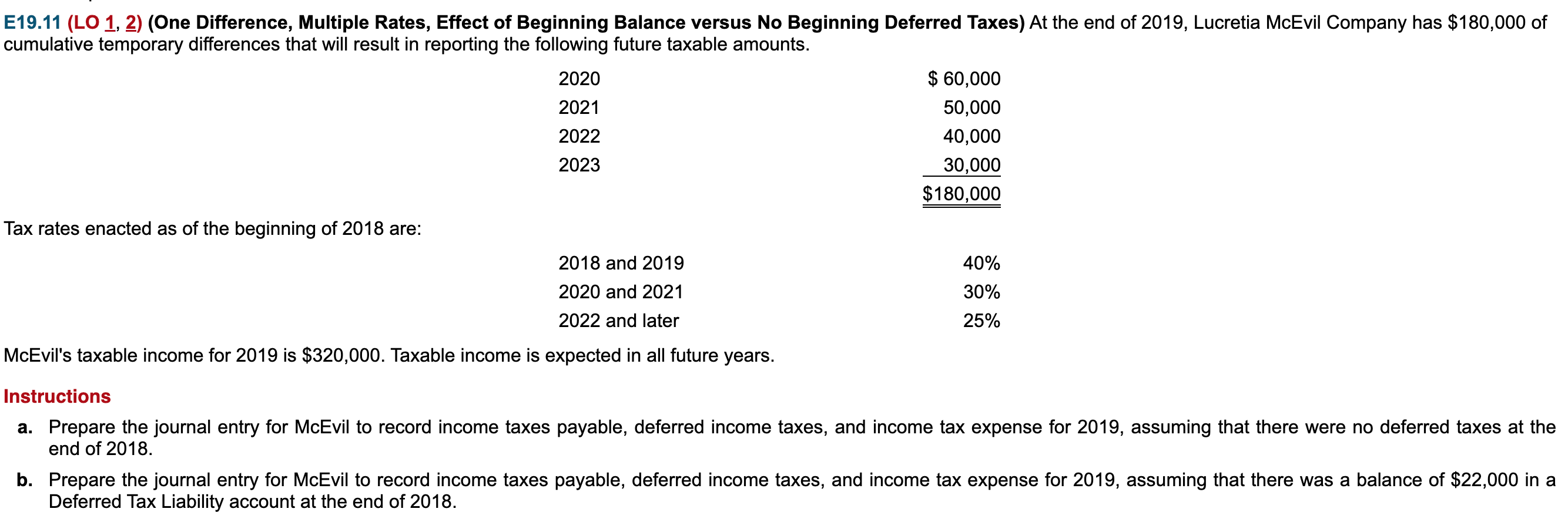

Tax rates enacted as of the beginning of 2018 are: McEvil's taxable income for 2019 is $320,000. Taxable income is expected in all future years. Instructions a. Prepare the journal entry for McEvil to record income taxes payable, deferred income taxes, and income tax expense for 2019 , assuming that there were no deferred taxes at the end of 2018. b. Prepare the journal entry for McEvil to record income taxes payable, deferred income taxes, and income tax expense for 2019 , assuming that there was a balance of $22,000 in a Deferred Tax Liability account at the end of 2018. Tax rates enacted as of the beginning of 2018 are: McEvil's taxable income for 2019 is $320,000. Taxable income is expected in all future years. Instructions a. Prepare the journal entry for McEvil to record income taxes payable, deferred income taxes, and income tax expense for 2019 , assuming that there were no deferred taxes at the end of 2018. b. Prepare the journal entry for McEvil to record income taxes payable, deferred income taxes, and income tax expense for 2019 , assuming that there was a balance of $22,000 in a Deferred Tax Liability account at the end of 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts