Question: Can someone explain to me how to do these problems please and thanks For the next three questions, please use the following bond information: AZN

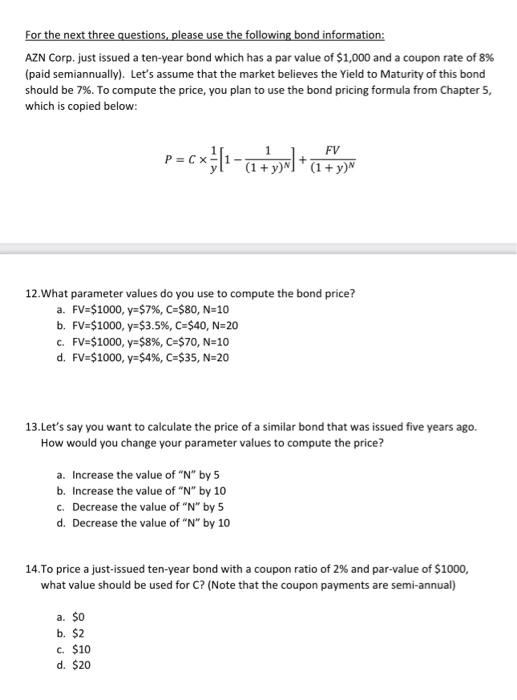

For the next three questions, please use the following bond information: AZN Corp. just issued a ten-year bond which has a par value of $1,000 and a coupon rate of 8% (paid semiannually). Let's assume that the market believes the Yield to Maturity of this bond should be 7%. To compute the price, you plan to use the bond pricing formula from Chapter 5 , which is copied below: P=Cy1[1(1+y)N1]+(1+y)NFV 12. What parameter values do you use to compute the bond price? a. FV=$1000,y=$7%,C=$80,N=10 b. FV=$1000,y=$3.5%,C=$40,N=20 c. FV=$1000,y=$8%,C=$70,N=10 d. FV=$1000,y=$4%,C=$35,N=20 13.Let's say you want to calculate the price of a similar bond that was issued five years ago. How would you change your parameter values to compute the price? a. Increase the value of " N " by 5 b. Increase the value of " N " by 10 c. Decrease the value of " N " by 5 d. Decrease the value of "N" by 10 14.To price a just-issued ten-year bond with a coupon ratio of 2% and par-value of $1000, what value should be used for C ? (Note that the coupon payments are semi-annual) a. $0 b. $2 c. $10 d. $20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts