Question: can someone explain what I have wrong. My spreadsheet is the right what Am i doing wrong? OK what about now? maitit: Pecwiend Required information

![information [The following information applies to the questions displayed below.] Sweeten Company](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67179502dfd10_722671795026a7cf.jpg)

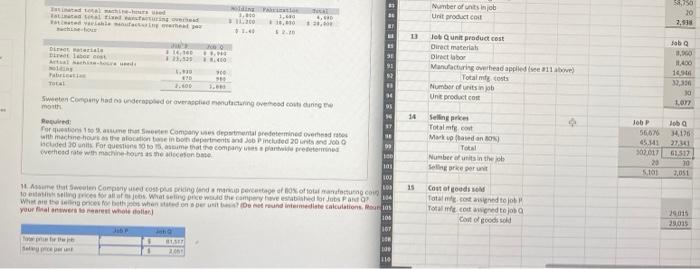

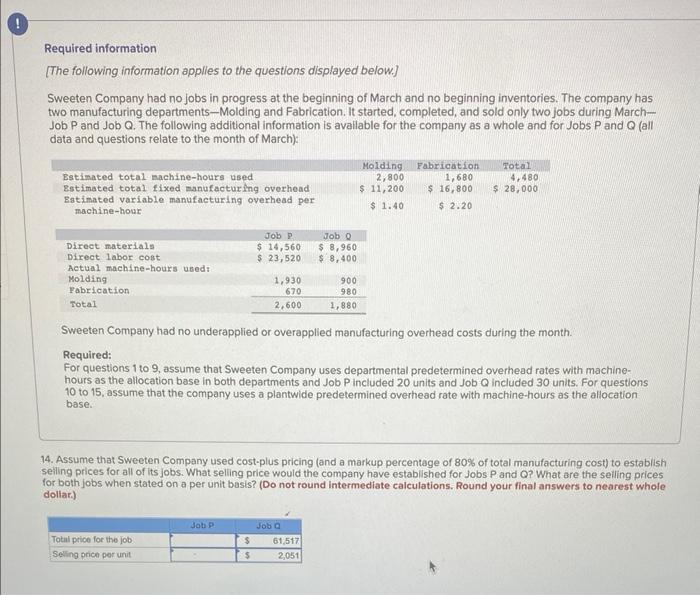

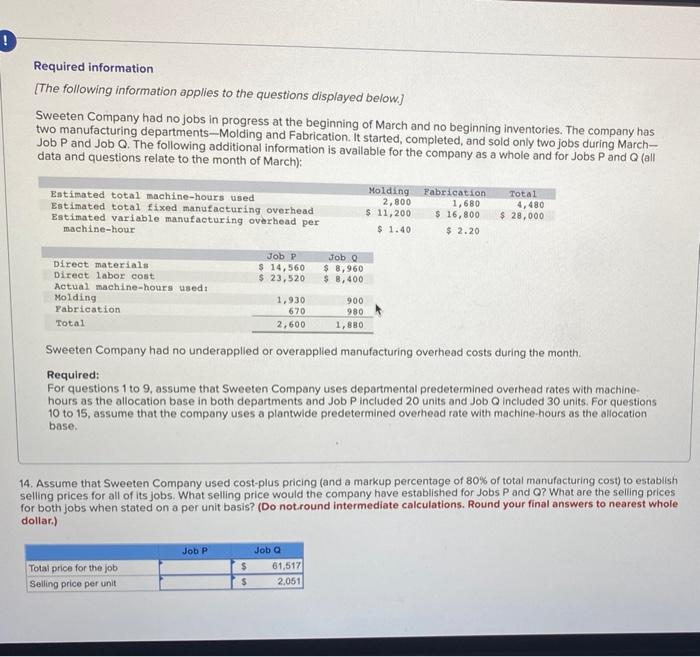

maitit: Pecwiend Required information [The following information applies to the questions displayed below.] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is avallable for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15 , assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. 14. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish seiling prices for all of its jobs. What selling price would the company have established for Jobs P and Q? What are the seiling prices for both jobs when stated on a per unit basis? (Do not round intermediate calculations. Round your final answers to nearest whole doliar) \begin{tabular}{|l|l} 14 & Selling prices \\ \hline & Total mfg. cost \\ \hline & Mark up (based on 80% ) \\ \hline \end{tabular} Required information [The following information applies to the questions displayed below.] Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments-Molding and Fabrication. It started, completed, and sold only two jobs during MarchJob P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March): Sweeten Company had no underapplied or overapplied manufacturing overhead costs during the month. Required: For questions 1 to 9, assume that Sweeten Company uses departmental predetermined overhead rates with machinehours as the allocation base in both departments and Job P included 20 units and Job Q included 30 units. For questions 10 to 15 , assume that the company uses a plantwide predetermined overhead rate with machine-hours as the allocation base. 14. Assume that Sweeten Company used cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. What selling price would the company have established for Jobs P and Q ? What are the selling prices for both jobs when stated on a per unit basis? (Do not.round intermediate calculations. Round your final answers to nearest whole dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts